While demand in some parts of Asia is strong, other countries such as China have been suffering from oversupply - World Highways reported from the Argus Asia-Pacific and Middle East Bitumen Conference in Singapore. Asia overtook the Americas as the world’s largest consumer of bitumen in 2012, with China accounting for the lion’s share – nearly two-thirds – of consumption. However, attendees at the Argus Asia-Pacific and Middle East Bitumen Conference held in Singapore on 24th-26th September last year heard

The Asian market has overtaken the US as the largest consumer of bitumen, with Chinese demand for roads being a key driver

While demand in some parts of Asia is strong, other countries such as China have been suffering from oversupply - World Highways reported from the 7582 Argus Asia-Pacific and Middle East Bitumen Conference in Singapore

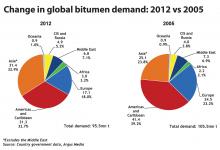

Asia overtook the Americas as the world’s largest consumer of bitumen in 2012, with China accounting for the lion’s share – nearly two-thirds – of consumption. However, attendees at the Argus Asia-Pacific and Middle East Bitumen Conference held in Singapore on 24th-26th September last year heard that demand may not continue at the same rate.

“After three to five years, the Asian bitumen market will be totally over-supplied,” warned Alex Hua, of the Rizhao Star bitumen Company who presented at the conference. “We should deliver more cargoes to other places.”

Prices in China have been forced down by over-supply and weak demand, said Hua, although things may pick up temporarily as the Government looks to finish projects by 2015 at the end of a five-year cycle.

The strategy for Rizhao Star, which has been operating its bitumen business in China for 20 years, is to decrease its imports and increase exports. It is to build a 50,000tonne terminal in Zhenhai port to export to Australia, Africa and America and build two terminals in Japan.

Aabha Ghandi, Asia Asphalt Editor for the Argus Asphalt Report, identified a number of other Asia-Pacific countries where demand is weakening including Thailand where politic turmoil is taking its toll, Malaysia where major projects are coming to an end and Indonesia where the rupiah is weak. However, in other countries, infrastructure investment will lead to a growing demand for bitumen. Paul Dalton, executive general manager of Boral (Bitumen and Oil Refineries Boral Limited) presented the changing face of bitumen supply in Australia, with only two of seven refineries now producing.

The closed refineries have been replaced by trading houses, importing from Singapore, Thailand, South Korea, Malaysia and Taiwan. With the Australian government’s focus on infrastructure projects it will remain a key importer, said Ghandi.

Dalton had this advice for those looking to export to Australia, “Product stewardship along with technical specification is critical for the Australian market.”

India is another promising market, with a renewed focus on infrastructure from its government expected in 2014 and 2015. Mahesh Advai, head of direct sales at Essar Oil told conference goers that $162 billion was to be spent on roads and bridges between 2012 and 2017, accounting for over 17% of India’s total infrastructure spend.

PPP models are favoured in road procurement, said Advai, with 85% of the national highways development programme procured through a Build-Operate-Transfer route. Advai identified opportunities in India for importing bitumen, developing storage infrastructure and bringing innovative packaging solutions.

Qatar has also emerged as a strong demand centre for bitumen, said Aabha, a trend which will continue up to the World Cup in 2022 as the country pushes to finish a raft of infrastructure projects. Qatar’s public works authority Ashgal has issued a tender for a five-year supply of bitumen.

Iranian bitumen companies face tough challenges due to the sanctions imposed on the country. However, with a falling domestic market, increasing exports is important, Kamran Kangari, commercial director for Binas Energy, told the conference.

Kangari identified three target markets for Iran: Turkey with its 2023 plan to build new road and rail networks; Oman with four major airports; and the UAE and Qatar with Expo 2020, a new airport at Doha and the 2022 World Cup in Qatar.

Looking to a brighter political future,7583 Binas Energy is establishing a new bitumen plant and export terminal with 20,000tonnes of storage in Bandar-Abbas. A pilot bitumen plant, packaging bitumen in jumbo bags and steel drums, will be replaced in 2016 with a facility with a capacity of 5,000 tonnes/day in 2016.

Siamak Esfehanian, commercial manager of trading company Kinetic Multiplier Pars, spoke about bitumen production in the Middle East and the UAE’s role in bitumen supply. Both Bahrain and Iran export to UAE, Oman and Qatar, with around a third of Iran’s bitumen sent to the UAE.

The UAE has invested in storage and shipping businesses to become a major bitumen hub, said Esfehanian. And he predicted that in the future, UAE would play an even stronger role with more bitumen plants, vessels, storage facilities, bulk trucks and drumming facilities.

As many of the firms that attended the event are doing, the conference’s last presentation looked overseas to opportunities in East Africa. Independent consultant Farjam Behrouzi explained some of the challenges in the more established markets of Kenya and Uganda and growing markets such as Southern Sudan.

The sixth Argus Europe Bitumen conference will be held from 10th-11th June 2015 in Istanbul, Turkey.

Asia overtook the Americas as the world’s largest consumer of bitumen in 2012, with China accounting for the lion’s share – nearly two-thirds – of consumption. However, attendees at the Argus Asia-Pacific and Middle East Bitumen Conference held in Singapore on 24th-26th September last year heard that demand may not continue at the same rate.

“After three to five years, the Asian bitumen market will be totally over-supplied,” warned Alex Hua, of the Rizhao Star bitumen Company who presented at the conference. “We should deliver more cargoes to other places.”

Prices in China have been forced down by over-supply and weak demand, said Hua, although things may pick up temporarily as the Government looks to finish projects by 2015 at the end of a five-year cycle.

The strategy for Rizhao Star, which has been operating its bitumen business in China for 20 years, is to decrease its imports and increase exports. It is to build a 50,000tonne terminal in Zhenhai port to export to Australia, Africa and America and build two terminals in Japan.

Aabha Ghandi, Asia Asphalt Editor for the Argus Asphalt Report, identified a number of other Asia-Pacific countries where demand is weakening including Thailand where politic turmoil is taking its toll, Malaysia where major projects are coming to an end and Indonesia where the rupiah is weak. However, in other countries, infrastructure investment will lead to a growing demand for bitumen. Paul Dalton, executive general manager of Boral (Bitumen and Oil Refineries Boral Limited) presented the changing face of bitumen supply in Australia, with only two of seven refineries now producing.

The closed refineries have been replaced by trading houses, importing from Singapore, Thailand, South Korea, Malaysia and Taiwan. With the Australian government’s focus on infrastructure projects it will remain a key importer, said Ghandi.

Dalton had this advice for those looking to export to Australia, “Product stewardship along with technical specification is critical for the Australian market.”

India is another promising market, with a renewed focus on infrastructure from its government expected in 2014 and 2015. Mahesh Advai, head of direct sales at Essar Oil told conference goers that $162 billion was to be spent on roads and bridges between 2012 and 2017, accounting for over 17% of India’s total infrastructure spend.

PPP models are favoured in road procurement, said Advai, with 85% of the national highways development programme procured through a Build-Operate-Transfer route. Advai identified opportunities in India for importing bitumen, developing storage infrastructure and bringing innovative packaging solutions.

Qatar has also emerged as a strong demand centre for bitumen, said Aabha, a trend which will continue up to the World Cup in 2022 as the country pushes to finish a raft of infrastructure projects. Qatar’s public works authority Ashgal has issued a tender for a five-year supply of bitumen.

Iranian bitumen companies face tough challenges due to the sanctions imposed on the country. However, with a falling domestic market, increasing exports is important, Kamran Kangari, commercial director for Binas Energy, told the conference.

Kangari identified three target markets for Iran: Turkey with its 2023 plan to build new road and rail networks; Oman with four major airports; and the UAE and Qatar with Expo 2020, a new airport at Doha and the 2022 World Cup in Qatar.

Looking to a brighter political future,

Siamak Esfehanian, commercial manager of trading company Kinetic Multiplier Pars, spoke about bitumen production in the Middle East and the UAE’s role in bitumen supply. Both Bahrain and Iran export to UAE, Oman and Qatar, with around a third of Iran’s bitumen sent to the UAE.

The UAE has invested in storage and shipping businesses to become a major bitumen hub, said Esfehanian. And he predicted that in the future, UAE would play an even stronger role with more bitumen plants, vessels, storage facilities, bulk trucks and drumming facilities.

As many of the firms that attended the event are doing, the conference’s last presentation looked overseas to opportunities in East Africa. Independent consultant Farjam Behrouzi explained some of the challenges in the more established markets of Kenya and Uganda and growing markets such as Southern Sudan.

The sixth Argus Europe Bitumen conference will be held from 10th-11th June 2015 in Istanbul, Turkey.