Asia’s emerging economies will be building roads for the next two decades, delegates at a recent Argus Asian Bitumen conference in Singapore heard. That means there are big opportunities for suppliers of bitumen, related technology and risk management companies - Kristina Smith reports One of the strongest messages to emerge from the Argus Asian Bitumen conference held in Singapore earlier this year is the sheer volume of road building planned in the region. For many countries there are political and finan

Asia’s emerging economies will be building roads for the next two decades, delegates at a recent Argus Asian Bitumen conference in Singapore heard. That means there are big opportunities for suppliers of bitumen, related technology and risk management companies - Kristina Smith reports

One of the strongest messages to emerge from the7582 Argus Asian Bitumen conference held in Singapore earlier this year is the sheer volume of road building planned in the region. For many countries there are political and financial hurdles to clear first, but in the medium- and long-term, these are important markets for those supplying bitumen and associated products and technology.

“Indonesia is one of the growing opportunities, Vietnam has some long-term road building projects, Bangaldesh too, most of these countries offer good opportunities,” said Edman Nafrieh, a speaker at the conference and managing director of Gilda Tar which supplies barrels of bitumen from Dubai into parts of Asia. “These are developing countries trying to develop and build roads on a long-term basis. There will be opportunities for the next 10-20 years.”

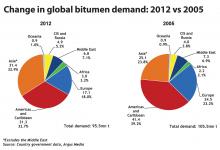

China is by far the biggest user of bitumen, accounting for over 60% of Asia’s demand according to the Argus Asphalt Report which tracks bitumen prices around the world. However, demand from China for imports is down: Aabha Gandi, the Report’s Asia editor, told the conference that imports will fall for the third year running in 2013 which has impacts around the region.

The reason is that China is increasing its production of asphalt, reported Aaron Huang, of Rizhao Star Asphalt Company which markets Korean asphalt to China and exports Chinese asphalt to Japan, Vietnam, the Philippines and Indonesia. While imports of bitumen to China will continue to decrease, exports from China will increase. “We believe the Asian asphalt market, including China, will form a new balance in the next three to five years,” said Huang.

In a couple of years, China will be turning its attention from road construction to maintenance. Ding Jinuxe from Chinese research body the Institute of Comprehensive Transportation of National Development and Reform Commission said that investment in road construction was set to peak in the period between 2010 and 2015. After 2015, the volume of construction will decrease gradually.

The focus in China is shifting to regional road networks, and road maintenance will take on an equal importance to road construction, said Jinuxe. China will eventually have 5.8 million km of road to maintain, according to the Institute.

Meanwhile, Australia is closing its refineries, with imports of bitumen now accounting for between 80 and 85% of supply, according to Argus. Australia is starting to accept bitumen from South Korea and Taiwan reported Gandi, with production in Thailand increasing to meet Australian demand.

Australia is a good market for Thai company Tipco Asphalt whose director, international marketing division Ismail Abdul Hamid, spoke at the conference. Tipco produces up to 1 million tonnes of bitumen/year at its Kemaman refinery in Malaysia.

As Tipco’s main product is bitumen, rather than a by-product as is the Case with oil refineries, it can produce bitumen which is right for a particular market, says Proud Teuytowong, international sales and marketing executive. “We can tailor the grade of bitumen that we produce at our refinery in Kemamam, Malaysia to a customer’s needs,” said Teuytowong. “Australian customers, for example need a viscosity grade.”

Tipco, whose sister company Tipco Maritime operates a fleet of seven ships, transports the bitumen from its Malaysia refinery to Thailand for processing in one of five plants and then exports some of it, mostly to Asia-Pacific countries. “China, Indonesia, Vietnam and Australia are our top four countries right now,” said Teuytowong.

The increased demand for imports from Australia has put pressure on shipping availability said Anil Himat, a director of Valencia Exim, which has both bitumen and shipping divisions, as vessels are effectively ‘out of action’ for longer as they make the long return journeys from Australia. Ships are set to get larger in the future, predicted Himat, with operators looking at ways to carry other cargoes on return journeys.

Though India is largely self-sufficient when it comes to bitumen, importing only 150,000tonnes, there are still opportunities for investors, Rexy Ravindran of Rex Fuels, a consultancy which focuses on petroleum and energy-related products, told the conference. He highlighted areas including bitumen storage and distribution facilities, polymer modified bitumen (PMB) plants and emulsion plants.

Traditionally, importing bitumen into India has not been an attractive proposition. Ravindran outlined some of the reasons why, including high discounts offered by domestic oil companies, high import duties and other taxes, and poor infrastructure at ports.

However, there could be a place for imports into India, suggested Ravindran, for example during the peak season between February and June when there is a mismatch between supply and demand. And chances to export bitumen during the monsoon period between July and October, he said.

Argus Report’s Gandi highlighted the importance of the coming election in India in 2014 – as the outcome will impact on bitumen demand in future years. Demand in 2013-2014 was expected to be weak, said Gandi, with any imports coming as drum bitumen from Iran.

Indonesia has 38,750km of roads in its national network, 34,004km of which have asphalt surfaces, 1,209km Penmac (penetration macadam which is made in-situ by rolling layers of aggregate and spraying with bitumen) and 3,358km gravel or earth. Its demand for bitumen each year is around 1.2 million tonnes, 750,000 of which is for maintenance.

With domestic production of around 500,000 million tonnes/year, Indonesia needs to import bitumen. Gandi reported that cargoes from China and India were now being accepted more often in Indonesia in addition to its usual sources of supply.

Rahadian outlined some of Indonesia’s planned road developments, including six priority economic corridors: Eastern Sumatra to North-west Java; Northern Java; Kalimantan; Western Sulawesi, East Java to Bali to Nusa Tenggara; and Papua. Between 2010 and 2014 over 15,000km of new roads will have been built with 3,400km planned for next year.

Indonesia also has a toll road network development programme, with a further 4,619km planned.

The 720km Sumatera highway will be delivered in four stages, starting from Bakaheuni in the South and finishing by the year 2025 at Banda Aceh in the North. The 617km trans-Java toll road network must be finished by 2014, said Rahadian, due to the economic importance of North Java. And the Great Jakarta toll road network, split into 10 sections, is also under development.

Sri Lanka’s Government has identified that developing the country’s road network will help transform the economy, said Ashoka Siriwardena, managing director of7584 Bitumix which manufactures bitumen-based products for the road and construction industry. “The Government has accorded the highest priority to improving the entire network of roads in the country with modern technology during the period between 2011 and 2020.”

BITUMEN AND ROAD BUILDING: THE PICTURE FOR ASIA

Here is a summary of some of the messages to emerge from the Argus Asian Bitumen conference, held in Singapore in September 2013.

CHINA: focus will shift from road building to road maintenance after 2015. Will import less and export more bitumen.

AUSTRALIA: refinery closures means increased demand for imported bitumen from Singapore, Korea and Malaysia.

INDIA: largely self-sufficient, demand for imported bitumen is weak. Next year’s election will impact on future road building.

INDONESIA: an emerging economy with significant road building programmes planned and underway.

SRI LANKA: Government has identified road-building as a top priority to speed up economic development.

VIETNAM: emerging economy, but demand for bitumen weakening due to fewer road projects.

MYANMAR: early days, but has a huge need for infrastructure of every kind, including road construction, repair and widening.

Siriwardena highlighted some of the expressway projects planned in the next five years: the North-South Highway, the Colombo-Kandy Highway, the Southern Highway Extension and the Colombo outer circular roads.

Bitumen supply comes from Sri Lanka’s Ceylon Petroleum Corporation, through refinery production and imports by the Lanka Indian Oil Company, Lanka Roadkem and some road construction companies. Most of the imported bitumen comes in drum form from the UAE, said Siriwardena.

Bitumen emulsions, cutback bitumen and oxidised bitumen are manufactured locally for use on Sri Lanka’s roads. PMB will be laid on Sri Lankan roads for the first time this year, said Siriwardena, with plastomer-type PMB introduced as the initial step.

Gandi reported that demand in Vietnam, also an emerging economy, is weakening at the moment due to fewer road projects. Imports to Vietnam come from Taiwan, China and Singapore with weather imports and currency fluctuations impacting on imports, according to Himat.

In the longer term, many people are looking towards Myanmar. Masaki Takahara, executive managing director of the Japan External Trade Organization (JETRO), based in Yangon in Myanmar highlighted the fact that many different types of Japanese businesses are investigating Myanmar, formerly Burma.

Factors which make it attractive to investors, said Takahara, include abundant and low cost labour, the country’s vast need for infrastructure and a potentially huge consumer market. Infrastructure development is required across the board: in power supply, communications, water and sewage, ports and roads.

Takahara highlighted the fact that while other South East Asian countries have been expanding their road networks significantly over the last two decades, Myanmar’s has only grown from 25,000km in 1990 to 27,000km now, with only 12% paved.

The key needs for Myanmar’s road network, according to Takahara, are: widening and repair work for trunk roads between cities and their feeder roads; construction of highways between strategic social economic zones and cities; creating plans for the cities of Yangon and Mandalay; and toll systems to ensure a maintenance budget.

Farjam Behrouzi of Iranian company7583 Binas Energy told the conference about the impact of the new resolution passed by the United Nations Security Council in June 2012 which intensified sanctions in some areas. There had been a reduction of demand from 12 countries, including China and India, which had been threatened with sanctions by the US, said Behrouzi.

The result has been that exports to Gulf Coast Countries have increased, since they act as a financial and logistical hub for Iranian bitumen. But the additional cost due to the extra shipping journeys and associated costs, including documentation, adds 20% onto the price, according to Behrouzi.

However, the election of the new, reformist president Dr Hassan Rouhani could see the lifting of sanctions over time, so that the UAE loses its function as a trading hub. Even as the conference was taking place in Singapore, the political situation in Iran was changing. “It was a really tough conference for us,” said Parya Karim, head of operation and logistics for Binas Energy. “While we were there, we did not know what was going to happen from one hour to the next.”

But already Rouhani’s election is having a positive impact: “After he was elected, we had lots of positive feedback,” said Karim.

“Market negotiations are easier than before.” However, Karim is realistic about the possible timeframe for sanctions to be lifted.

Another positive change, said Parim, is that the exchange rate for the Rial has become more stable. “The exchange rate fluctuations were very really irritating for those of us doing business,” she said. “After the presidential election, the exchange rate has steadied.”

Forthcoming Argus Asphalt conferences: Cape Town, South Africa 25-27 February 2014; Woodlands, Texas 26-28 March 2014; Rome, Italy 11-12 June 2014.

New ideas for the Asian market: hydrogen sulphide scavengers

Hydrogen sulphide can mean much more than an unpleasant odour. At higher concentrations it can lead to watering eyes, difficulty in breathing and – at levels above 500 parts per million (ppm) –death after just one breath.

While the safety issues are known in the US and Europe, other parts of the world have yet to address them. “We are getting enquiries from Australia and the Far East, in relation to nuisance smells, “ says Tony O’Brien, fuel additives manager for NALCO Champion. “What no one is picking up on is that it is a toxic gas.”

NALCO Champion, part of the ECOLAB group, supplies hydrogen sulphide scavengers, as well as other treatments, for oil production, refineries and petrochemical plants. Hydrogen sulphide scavengers are chemicals that are added at specific times during bitumen processing to reduce or remove hydrogen sulphide.

NALCO Champion gave a presentation at the Argus Asian Bitumen conference in order to raise awareness in the region. “We see opportunities in all the countries,” said O’Brien. “Our main areas at the moment are China, Thailand, Indonesia, India and Singapore – that’s where we are seeing the most rapid growth. But we are also getting enquiries from Vietnam and Sri Lanka.”

While most refineries are well aware of hydrogen sulphide, and have safety procedures in place to protect personnel, further down the line companies may not be so aware. Problems can arise at polymer modified bitumen (PMB) manufacturing plants or in storage tanks.

One of the issues facing the industry currently is that there is no standard test to determine hydrogen sulphide levels, although an ISO Group is looking to develop one, says O’Brien. NALCO Champion has developed a field method to test hydrogen sulphide levels. “We need an industry-accepted method,” says O’Brien. “Until there’s an agreed method, there cannot be a standard.”

New ideas for the Asian market: bitumen hedging

One of the speakers at the Argus Asian Bitumen conference in Singapore was Ashkat Jaswal, a senior risk management consultant with INTL FCStone. He was talking to the conference about bitumen hedging, which allows buyers or sellers of bitumen to take the risk out of fluctuating bitumen prices.

Though large Asian refineries and traders do hedge – “it’s in their DNA,”– most, said Jaswal, who is based in Singapore, “The medium sized guys predominantly don’t hedge,” he said. “The conference was an opportunity to educate people about how to start managing risk.

“What I found out from the conference was that it’s not something people are looking at or have even been told about.”

Sellers and traders in Japan may be hedging, added Jaswal, but players in UAE, Indonesia and Malaysia don’t.

Fluctuating commodity prices are not always the main concern in this region, however, says Jaswal. “A large proportion of bitumen flows in from Iraq,” he said. “So they are more concerned about the foreign exchange rates.”

Perhaps those who could benefit most from bitumen hedging would be the large road contractors, said Jaswal. “On some contracts the risks are borne by the Government; some contracts have escalation clauses to take into account rising materials prices, but a lot of contracts don’t have that,” he said.

Hedging could help contractors to put in a more attractive bid, said Jaswal. “A contractor can bid and say ‘We are not going to pass any price hikes on to you, and if the price falls, we will pass on the benefit to you’.” And it wouldn’t just be bitumen as companies like INTL FCStone can work with contractors to help manage diesel price risk as well.

One of the strongest messages to emerge from the

“Indonesia is one of the growing opportunities, Vietnam has some long-term road building projects, Bangaldesh too, most of these countries offer good opportunities,” said Edman Nafrieh, a speaker at the conference and managing director of Gilda Tar which supplies barrels of bitumen from Dubai into parts of Asia. “These are developing countries trying to develop and build roads on a long-term basis. There will be opportunities for the next 10-20 years.”

China is by far the biggest user of bitumen, accounting for over 60% of Asia’s demand according to the Argus Asphalt Report which tracks bitumen prices around the world. However, demand from China for imports is down: Aabha Gandi, the Report’s Asia editor, told the conference that imports will fall for the third year running in 2013 which has impacts around the region.

The reason is that China is increasing its production of asphalt, reported Aaron Huang, of Rizhao Star Asphalt Company which markets Korean asphalt to China and exports Chinese asphalt to Japan, Vietnam, the Philippines and Indonesia. While imports of bitumen to China will continue to decrease, exports from China will increase. “We believe the Asian asphalt market, including China, will form a new balance in the next three to five years,” said Huang.

In a couple of years, China will be turning its attention from road construction to maintenance. Ding Jinuxe from Chinese research body the Institute of Comprehensive Transportation of National Development and Reform Commission said that investment in road construction was set to peak in the period between 2010 and 2015. After 2015, the volume of construction will decrease gradually.

The focus in China is shifting to regional road networks, and road maintenance will take on an equal importance to road construction, said Jinuxe. China will eventually have 5.8 million km of road to maintain, according to the Institute.

Meanwhile, Australia is closing its refineries, with imports of bitumen now accounting for between 80 and 85% of supply, according to Argus. Australia is starting to accept bitumen from South Korea and Taiwan reported Gandi, with production in Thailand increasing to meet Australian demand.

Australia is a good market for Thai company Tipco Asphalt whose director, international marketing division Ismail Abdul Hamid, spoke at the conference. Tipco produces up to 1 million tonnes of bitumen/year at its Kemaman refinery in Malaysia.

As Tipco’s main product is bitumen, rather than a by-product as is the Case with oil refineries, it can produce bitumen which is right for a particular market, says Proud Teuytowong, international sales and marketing executive. “We can tailor the grade of bitumen that we produce at our refinery in Kemamam, Malaysia to a customer’s needs,” said Teuytowong. “Australian customers, for example need a viscosity grade.”

Tipco, whose sister company Tipco Maritime operates a fleet of seven ships, transports the bitumen from its Malaysia refinery to Thailand for processing in one of five plants and then exports some of it, mostly to Asia-Pacific countries. “China, Indonesia, Vietnam and Australia are our top four countries right now,” said Teuytowong.

The increased demand for imports from Australia has put pressure on shipping availability said Anil Himat, a director of Valencia Exim, which has both bitumen and shipping divisions, as vessels are effectively ‘out of action’ for longer as they make the long return journeys from Australia. Ships are set to get larger in the future, predicted Himat, with operators looking at ways to carry other cargoes on return journeys.

Though India is largely self-sufficient when it comes to bitumen, importing only 150,000tonnes, there are still opportunities for investors, Rexy Ravindran of Rex Fuels, a consultancy which focuses on petroleum and energy-related products, told the conference. He highlighted areas including bitumen storage and distribution facilities, polymer modified bitumen (PMB) plants and emulsion plants.

Traditionally, importing bitumen into India has not been an attractive proposition. Ravindran outlined some of the reasons why, including high discounts offered by domestic oil companies, high import duties and other taxes, and poor infrastructure at ports.

However, there could be a place for imports into India, suggested Ravindran, for example during the peak season between February and June when there is a mismatch between supply and demand. And chances to export bitumen during the monsoon period between July and October, he said.

Argus Report’s Gandi highlighted the importance of the coming election in India in 2014 – as the outcome will impact on bitumen demand in future years. Demand in 2013-2014 was expected to be weak, said Gandi, with any imports coming as drum bitumen from Iran.

Future prospects

Among the emerging countries which need to create infrastructure in order to grow their economies is Indonesia. Hedy Rahadian, deputy director of road engineering for Indonesia’s Directorate of General Highways, showed how the country’s budget for national roads has increased every year since 2008. “As of 2013, the budget for asphalt mixture alone will be not less than US $10 billion,” said Rahadian.Indonesia has 38,750km of roads in its national network, 34,004km of which have asphalt surfaces, 1,209km Penmac (penetration macadam which is made in-situ by rolling layers of aggregate and spraying with bitumen) and 3,358km gravel or earth. Its demand for bitumen each year is around 1.2 million tonnes, 750,000 of which is for maintenance.

With domestic production of around 500,000 million tonnes/year, Indonesia needs to import bitumen. Gandi reported that cargoes from China and India were now being accepted more often in Indonesia in addition to its usual sources of supply.

Rahadian outlined some of Indonesia’s planned road developments, including six priority economic corridors: Eastern Sumatra to North-west Java; Northern Java; Kalimantan; Western Sulawesi, East Java to Bali to Nusa Tenggara; and Papua. Between 2010 and 2014 over 15,000km of new roads will have been built with 3,400km planned for next year.

Indonesia also has a toll road network development programme, with a further 4,619km planned.

The 720km Sumatera highway will be delivered in four stages, starting from Bakaheuni in the South and finishing by the year 2025 at Banda Aceh in the North. The 617km trans-Java toll road network must be finished by 2014, said Rahadian, due to the economic importance of North Java. And the Great Jakarta toll road network, split into 10 sections, is also under development.

Sri Lanka’s Government has identified that developing the country’s road network will help transform the economy, said Ashoka Siriwardena, managing director of

BITUMEN AND ROAD BUILDING: THE PICTURE FOR ASIA

Here is a summary of some of the messages to emerge from the Argus Asian Bitumen conference, held in Singapore in September 2013.

CHINA: focus will shift from road building to road maintenance after 2015. Will import less and export more bitumen.

AUSTRALIA: refinery closures means increased demand for imported bitumen from Singapore, Korea and Malaysia.

INDIA: largely self-sufficient, demand for imported bitumen is weak. Next year’s election will impact on future road building.

INDONESIA: an emerging economy with significant road building programmes planned and underway.

SRI LANKA: Government has identified road-building as a top priority to speed up economic development.

VIETNAM: emerging economy, but demand for bitumen weakening due to fewer road projects.

MYANMAR: early days, but has a huge need for infrastructure of every kind, including road construction, repair and widening.

Siriwardena highlighted some of the expressway projects planned in the next five years: the North-South Highway, the Colombo-Kandy Highway, the Southern Highway Extension and the Colombo outer circular roads.

Bitumen supply comes from Sri Lanka’s Ceylon Petroleum Corporation, through refinery production and imports by the Lanka Indian Oil Company, Lanka Roadkem and some road construction companies. Most of the imported bitumen comes in drum form from the UAE, said Siriwardena.

Bitumen emulsions, cutback bitumen and oxidised bitumen are manufactured locally for use on Sri Lanka’s roads. PMB will be laid on Sri Lankan roads for the first time this year, said Siriwardena, with plastomer-type PMB introduced as the initial step.

Gandi reported that demand in Vietnam, also an emerging economy, is weakening at the moment due to fewer road projects. Imports to Vietnam come from Taiwan, China and Singapore with weather imports and currency fluctuations impacting on imports, according to Himat.

In the longer term, many people are looking towards Myanmar. Masaki Takahara, executive managing director of the Japan External Trade Organization (JETRO), based in Yangon in Myanmar highlighted the fact that many different types of Japanese businesses are investigating Myanmar, formerly Burma.

Factors which make it attractive to investors, said Takahara, include abundant and low cost labour, the country’s vast need for infrastructure and a potentially huge consumer market. Infrastructure development is required across the board: in power supply, communications, water and sewage, ports and roads.

Takahara highlighted the fact that while other South East Asian countries have been expanding their road networks significantly over the last two decades, Myanmar’s has only grown from 25,000km in 1990 to 27,000km now, with only 12% paved.

The key needs for Myanmar’s road network, according to Takahara, are: widening and repair work for trunk roads between cities and their feeder roads; construction of highways between strategic social economic zones and cities; creating plans for the cities of Yangon and Mandalay; and toll systems to ensure a maintenance budget.

More change to come?

Much of Asia’s bitumen supply comes from Iran. Some countries can accept direct shipments. But for others which cannot accept Iranian exports directly due to sanctions, this bitumen comes via Gulf Coast Countries.Farjam Behrouzi of Iranian company

The result has been that exports to Gulf Coast Countries have increased, since they act as a financial and logistical hub for Iranian bitumen. But the additional cost due to the extra shipping journeys and associated costs, including documentation, adds 20% onto the price, according to Behrouzi.

However, the election of the new, reformist president Dr Hassan Rouhani could see the lifting of sanctions over time, so that the UAE loses its function as a trading hub. Even as the conference was taking place in Singapore, the political situation in Iran was changing. “It was a really tough conference for us,” said Parya Karim, head of operation and logistics for Binas Energy. “While we were there, we did not know what was going to happen from one hour to the next.”

But already Rouhani’s election is having a positive impact: “After he was elected, we had lots of positive feedback,” said Karim.

“Market negotiations are easier than before.” However, Karim is realistic about the possible timeframe for sanctions to be lifted.

Another positive change, said Parim, is that the exchange rate for the Rial has become more stable. “The exchange rate fluctuations were very really irritating for those of us doing business,” she said. “After the presidential election, the exchange rate has steadied.”

Forthcoming Argus Asphalt conferences: Cape Town, South Africa 25-27 February 2014; Woodlands, Texas 26-28 March 2014; Rome, Italy 11-12 June 2014.

New ideas for the Asian market: hydrogen sulphide scavengers

Hydrogen sulphide can mean much more than an unpleasant odour. At higher concentrations it can lead to watering eyes, difficulty in breathing and – at levels above 500 parts per million (ppm) –death after just one breath.

While the safety issues are known in the US and Europe, other parts of the world have yet to address them. “We are getting enquiries from Australia and the Far East, in relation to nuisance smells, “ says Tony O’Brien, fuel additives manager for NALCO Champion. “What no one is picking up on is that it is a toxic gas.”

NALCO Champion, part of the ECOLAB group, supplies hydrogen sulphide scavengers, as well as other treatments, for oil production, refineries and petrochemical plants. Hydrogen sulphide scavengers are chemicals that are added at specific times during bitumen processing to reduce or remove hydrogen sulphide.

NALCO Champion gave a presentation at the Argus Asian Bitumen conference in order to raise awareness in the region. “We see opportunities in all the countries,” said O’Brien. “Our main areas at the moment are China, Thailand, Indonesia, India and Singapore – that’s where we are seeing the most rapid growth. But we are also getting enquiries from Vietnam and Sri Lanka.”

While most refineries are well aware of hydrogen sulphide, and have safety procedures in place to protect personnel, further down the line companies may not be so aware. Problems can arise at polymer modified bitumen (PMB) manufacturing plants or in storage tanks.

One of the issues facing the industry currently is that there is no standard test to determine hydrogen sulphide levels, although an ISO Group is looking to develop one, says O’Brien. NALCO Champion has developed a field method to test hydrogen sulphide levels. “We need an industry-accepted method,” says O’Brien. “Until there’s an agreed method, there cannot be a standard.”

New ideas for the Asian market: bitumen hedging

One of the speakers at the Argus Asian Bitumen conference in Singapore was Ashkat Jaswal, a senior risk management consultant with INTL FCStone. He was talking to the conference about bitumen hedging, which allows buyers or sellers of bitumen to take the risk out of fluctuating bitumen prices.

Though large Asian refineries and traders do hedge – “it’s in their DNA,”– most, said Jaswal, who is based in Singapore, “The medium sized guys predominantly don’t hedge,” he said. “The conference was an opportunity to educate people about how to start managing risk.

“What I found out from the conference was that it’s not something people are looking at or have even been told about.”

Sellers and traders in Japan may be hedging, added Jaswal, but players in UAE, Indonesia and Malaysia don’t.

Fluctuating commodity prices are not always the main concern in this region, however, says Jaswal. “A large proportion of bitumen flows in from Iraq,” he said. “So they are more concerned about the foreign exchange rates.”

Perhaps those who could benefit most from bitumen hedging would be the large road contractors, said Jaswal. “On some contracts the risks are borne by the Government; some contracts have escalation clauses to take into account rising materials prices, but a lot of contracts don’t have that,” he said.

Hedging could help contractors to put in a more attractive bid, said Jaswal. “A contractor can bid and say ‘We are not going to pass any price hikes on to you, and if the price falls, we will pass on the benefit to you’.” And it wouldn’t just be bitumen as companies like INTL FCStone can work with contractors to help manage diesel price risk as well.