A report has been released for the construction machinery rental market in the EU.

A market report into the EU construction machinery rental sector is now available – image © courtesy of Mike Woof

The European Rental Association (ERA) has released its 2020 Market Report, which has been produced with the support of the ERA Statistics Committee.

This year, more than ever, providing a clear picture of the short- and medium-term outlook for the rental market is critical not only for rental companies, but also for equipment manufacturers.

This edition, comprising market trends and international comparisons, uses a common methodology and definition to analyse 15 European markets, with detailed market size results for 2017-18 (actual), 2019-20 (estimates) and 2021-22 (forecasts). These countries account for more than 95% of the equipment rental industry in the EU, European Free Trade Association (EFTA) and the UK.

In 2019, equipment rental companies and other companies providing rental services generated a total rental turnover of more than €27.7 billion in these countries (EU-EFTA-UK).

The release of national statistics vary across the region and this year there are only two countries, Germany and Austria, for which 2018 Eurostat data is available. For all the other countries, only 2017 figures are available. Therefore, for those, the 2018 and 2019 figures were based on forecast drivers only.

At a constant exchange rate, the equipment rental industry in the 15 countries saw growth of 4.1% in 2019. In 2020, there is an estimated decrease of 10.4%, with 2021 forecast to increase by 4.8%, also at a constant exchange rate.

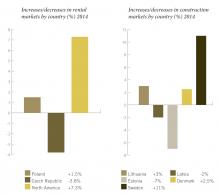

The headline conclusion from this year’s report is that 2019 was a year of growth for all the markets covered. This growth, however, was at different stages, with some markets already slowing down (France, Belgium, Sweden) and others still reporting robust growth (Germany, Poland, Italy). The first quarter of 2020 reflected these dynamics.

The COVID-19 pandemic, however, hit European economies over the second quarter of this year. The immediate impact differed from country to country. The Nordic countries, which did not lockdown and had almost no site shutdowns, have performed differently to southern Europe and the UK, which faced severe lockdowns and disruptions to activity. The UK has been further impacted by the uncertainty surrounding the Brexit negotiations.

The estimates and forecasts included in this report are based on assumptions at the end of September. The hypothesis is that there will be no further lockdowns across Europe apart from local and temporary restrictions. The forecast also does not factor in the development and mass availability of a vaccine.

It is important to stress the extreme conditions of 2020, which have been analysed with the forecasts for 2021. Large drops are expected this year, but significant rises – some of them due to technical rebounds – are expected in the short-term, as well as in the medium- to long-term.

The ERA Market Report is the leading source of market intelligence on the European equipment rental market and the only Europe-wide industry benchmark. It contains detailed market information for the years 2016 to 2022 and key indicators, including rental turnover, fleet value and investments.

The report is available digitally for ERA members (€500) and for non-members (€1,200).