The machine rental sector is undergoing significant expansion worldwide – Dan Gilkes reports. Plant hire, equipment rental, leasing, call it what you will, being able to use a machine when and where you need it, with no further concerns relating to ownership costs, depreciation or sudden repair bills, remains a compelling argument for many contractors. Which is one of the main reasons for the continued growth in popularity of equipment rental across the world. Rental has been big business in the UK, the US

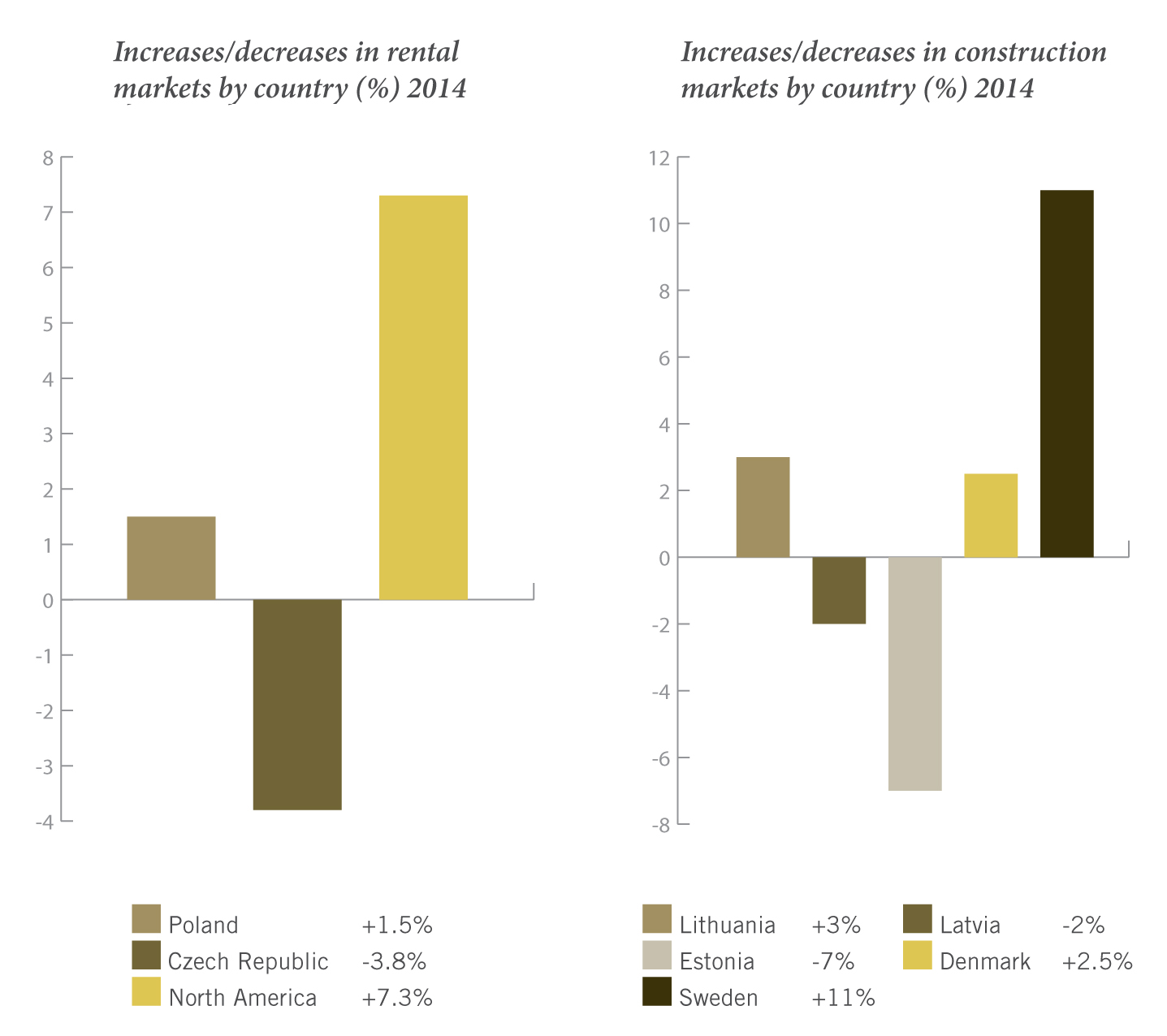

LEFT: Increases/decreases in rental markets by country (%) 2014; RIGHT: Increases/decreases in construction markets by country (%) 2014

The machine rental sector is undergoing significant expansion worldwide – Dan Gilkes reports

Plant hire, equipment rental, leasing, call it what you will, being able to use a machine when and where you need it, with no further concerns relating to ownership costs, depreciation or sudden repair bills, remains a compelling argument for many contractors. Which is one of the main reasons for the continued growth in popularity of equipment rental across the world.

Rental has been big business in the UK, the US and some European countries for many years, indeed at least 80% of all machinery sold in the UK market goes to plant hire companies. However it remains a minor part of the construction equipment mix in other countries, as contractors prefer the security of asset ownership and machine availability, over the convenience and off-balance sheet attraction of rental.

Rental has also become an important outlet for many equipment manufacturers, not just as a possible customer, but as an operating division. The Cat Rental Store was among the first to become a regular feature of the market, in effect competing directly with some of its own customers.718 Liebherr also offers a rental business, though only of its own equipment, in the UK, Germany, Austria, Switzerland and France, while 2394 Volvo and 176 Case have had rental interests too. The Cat Rental Store remains the largest however and now has 1,429 dealer-owned locations across the world, providing both Cat and non-178 Caterpillar equipment.

“Cost of ownership, economic cycles, duration of jobs and contractors covering a wide range of geographic areas making transporting equipment less attractive, are all factors,” said a Caterpillar spokesperson.

“Cat dealers are making it easy for customers to do business by providing the latest technology in machines, with fleets of young equipment supported by expert advice to select the best solution for the job.

“As the economic situation across the globe is uncertain, rental will be more and more a solution that our customers will be looking for. We have markets that are already mature such as the UK or France, with high rental penetration, but rental penetration is growing in emerging countries too,” said Cat.

“Clearly specialisation is one of the trends that is being followed by many rental companies in Europe, while our network, with a large offer of Cat and complementary equipment, is able to provide machines to all the different sectors.”

Hiring in machinery also keeps the cost of that plant off your balance sheet, with none of the usual concerns over depreciation or future residual value. Several European countries also offer fiscal incentives for rental, further boosting its appeal.

The flip side of that, is that a company might find it hard to raise finance when required, without solid assets on its books to offset and guarantee a loan. Having total control of fleet availability is also a strong concern for some.

While some companies have the luxury of maximum utilisation of their machinery, particularly in production-intensive areas such as quarrying and mining, general construction can be far more seasonal, with project duration much shorter and certainly well within the lifetime of the machinery. The rental industry can therefore supply a specific machine for a short duration task, with none of the investment concerns related to ownership.

Having the right machine for the job is an important consideration too. A company that has purchased a 40tonne excavator for instance will not want to put it to work on a site that really needs a 25tonne machine, as it will be inefficient and costly. Being able to specify the right equipment for the job, is often the most efficient method of working. In many cases rental also means that you will get the latest available plant, with the benefits of full legislative compliance, the highest levels of productivity and the lowest exhaust emissions, which might be an important consideration particularly for government-sponsored works.

When considering whether to opt for some sort of purchase agreement or a rental or leasing deal, companies have many things to consider. However both the rental machine and the purchased model can both be calculated as a total whole life cost.

For the rental machine you need to look at the daily or monthly rental rate. Then work out what your utilisation will be; do you need the machine all of the time or just for occasional work? Interest payments made on a monthly rental payment may not be the only interest that has to be paid either. If for example the company utilises an agreed overdraft, there will be additional interest owing, through making regular payments by using funds against that overdraft.

If you considering buying the machinery, the whole life calculation is more complex, with several variables that will only be realised over time. There is of course the purchase cost, plus any interest if the equipment is being purchased on a hire purchase agreement.

You will need to work out how many years the machine will be used by your company, and calculate a residual value to work out potential depreciation. Regular maintenance costs, including tyres or tracks will be another factor, even if the machine is supplied with a full repair and maintenance contract. Many companies work on maintenance costs being around 5-10% of the purchase cost of a machine, without incorporating wear parts such as bucket teeth or cutting edges. Plus you always have to factor in the unexpected breakdown, though to some extent that can be covered by an extended warranty, another expense to add to the list.

There is little doubt that, particularly as equipment becomes more complex and contractors move away from having their own service and maintenance departments, rental has become a more popular option. Passing the risk involved with machine ownership and operation to another company is for many, worth the additional expense of a rental contract.

Traditionally, the majority of rental in the construction sector has been related to smaller machinery, typically under 20tonnes operating weight. However, the European Rental Association (ERA) says that major construction contractors have started outsourcing their equipment needs further up the weight scale, to between 20-50tonnes. This includes wheeled loaders, excavators and compactors as well as the smaller mini excavators, backhoe loaders and compaction machinery. This may in part be due to shorter project durations, with contractors less inclined to invest in machinery for a limited return. No doubt there is also an element of management contracting at work too, as main contractors take over the project management but leave it to subcontractors to carry out earthworks and construction processes.

As is so often the case, the figures vary wildly when you look at individual countries though. For example, while the UK remained the strongest rental market in Europe, with growth in 2013 of 10%, the Polish market in comparison saw a slowdown according to the ERA.

That said, Finnish rental company Ramirent says the Polish market and the Baltic States in general, look set to recover slightly over the coming year. “In the Baltics, our operations developed favourably, backed by stable market conditions,” said Ramirent ceo Magnus Rosen.

“In Europe Central, demand for equipment rental improved in Poland and the Czech Republic, while market activity is low in Slovakia.

“The construction market is estimated to increase in Lithuania by 3% and to decrease in Latvia by 2% and in Estonia by 7%. Residential construction in the Baltic States is estimated to grow supported by new building start-ups and improving consumer confidence.

“Non-residential construction is expected to recover in Latvia and Lithuania during 2014. The market in infrastructure construction is at a lower level due to a transition period in EU funding. High activity in the energy sector will support the Baltic equipment rental markets in 2014.” A report published by ERA in October 2014 puts Polish equipment rental market growth at 1.5% through 2014, while in the Czech Republic the construction market is expected to decrease by 3.8%.

Things are looking more positive in Ramirent’s domestic Scandinavian markets though. A forecast from the Swedish Construction Federation in October 2014 said that the Swedish construction market should increase by a healthy 11% in 2014, with residential construction in particular well up on the previous year.

Non-residential construction also looks healthy, with infrastructure projects in Stockholm and Gothenburg in particular boosting demand.

The Norwegian market is experiencing similar growth, though residential construction has dropped while infrastructure remains stable, thanks in part to government grants for railway and metro projects. That said, overcapacity in the Norwegian rental market was expected to have an impact on sales in the fourth quarter of 2014.

Denmark looks slightly healthier too, according to a report from the Danish Construction Industry, with growth in 2014 expected to hit around 2.5%. Health and education spending will push non-residential growth, while several new transport projects and energy investments will strengthen infrastructure.

One of the ways that Ramirent has continued to build its business is with longer-term rental contracts with major contractors, providing projects with equipment on a national and international scale.

“An important new agreement during the quarter was the signing of a three-year rental agreement with2296 Skanska’s machinery department in Sweden,” said Mr Rosen. “We renewed the cooperation agreement with 1209 Veidekke in Norway for the next three years. In Finland, construction company Hartela outsourced their tower cranes fleet to Ramirent and signed a five-year rental agreement.

“We continue to develop our organisation to efficiently cater for the specific needs of customers renting over-the-counter and for customers to whom we deliver integrated solutions.”

“This latest forecast continues to demonstrate a strong growth pattern for our industry,” says Christine Wehrman, executive vice president and CEO of the ARA. With such strong predictions, the ARA expects rental companies in the US to continue to invest more than 30% of their revenue in new equipment over the next five years.

In the next four years, the construction and industrial segment and the general tool segment are expected to experience near double-digit growth in US rental revenue. In 2015 construction and industrial rental revenue is projected to increase 9.8% and general tool 9.0%, followed by 7.9% and 8.1% in 2016, 8.6% and 9.8% in 2017 and 9.0% and 11.8% in 2018, respectively according to the ARA.

US-based United Rentals, perhaps the world’s largest equipment rental company with 882 locations in 49 US states and 10 Canadian provinces, reported North American rental revenues rising by 15.6% year on year in October.

“The third quarter provided further confirmation that our strategy and the North American construction recovery are both solidly on track,” said Michael Kneeland, United’s CEO.

“Our end markets are continuing to rally, creating numerous opportunities for well-managed, profitable growth. We reported a robust 16% increase in rental revenue for the quarter and more importantly, the discipline behind that growth is evident in our record earnings before interest, taxes, depreciation

and amortisation margin and gains in volume, utilisation and rates.”

Mr Kneeland continued: “While we reported very strong results, we believe they reflect just a fraction of what our company can achieve over multiple years in the forecasted upcycle. More immediately, we believe that the current uncertainty in the financial markets relates to global concerns, and not North America.

“We’ll continue to take the actions that drive returns over time, including rigorous fleet management, the expansion of our speciality rental lines, and transformational measures for greater productivity.”

UK-based Ashtead Group, which owns UK hire firm6264 A-Plant and the US business 6476 Sunbelt Rentals, has also posted strong results in September 2014. The group saw rental revenue rise by 22% in its first quarter of 2014-15 to £417.7 million. Q1 profit also hit a record high, up 33% at £120 million.

“We are pleased to report another strong quarter as we continue to capitalise on recovering markets and take further market share in both Sunbelt and A-Plant,” said chief executive Geoff Drabble.

“Sunbelt delivered 22% rental revenue growth and A-Plant 19% which, together with a focus on operational efficiency, helped to deliver record underlying pre-tax profits of £120 million.

“We invested £284 million in capital expenditure and a further £32 million on bolt-on acquisitions in the quarter, as we continue our strategy focussed on organic growth supplemented by bolt-on acquisitions. Given the momentum evident in the business, we are increasing our full year guidance for capital expenditure to a range of £825 million to £875 million.

“As a result of this strong performance, and with a strong balance sheet to support future growth, we now anticipate a full year result ahead of our previous expectations.”

3978 Hertz Equipment Rental (HERC) continuing to expand in the region to meet demand. In a joint venture agreement with Dayim Holdings and 5903 Phoenix Project development, Hertz Dayim Equipment Rental opened a business in Doha, Qatar, late in 2014. This was the first time that Hertz Dayim has expanded outside Saudi Arabia, where the partnership was first established four years ago. The JV had already opened a new location in Riyadh, Saudi Arabia last year and also has plans for additional outlets.

“Regional expansion is a major strategic objective for Hertz Dayim Equipment Rental and I believe that Qatar is the right place to begin this expansion,” said chairman HRH Prince Khalid bin Bandar bin Sultan.

Hertz Dayim saw the opportunity in Qatar to provide a premium full line rental service as the majority of the competition in the market concentrate on one or two product lines. The company’s entry into the sector is based on a business model that provides a wide range of equipment to satisfy a greater number of customers involved in stadium construction, metro, ports, rail, drainage systems and highways, in addition to the traditional petro-chemical, oil and gas projects.

“Infrastructure and construction sectors in Qatar are expected to see massive growth because of the FIFA World Cup in 2022, leading to heavy demand for construction equipment and related rental services,” said the Prince.

“With Qatar’s planned infrastructure megaprojects over the next five years, Hertz Dayim is well positioned for expansion into the Gulf States. Regional presence will give scale to our business, as well as the flexibility to move fleet across different Gulf Corporation Council markets. We are confident that we will replicate the success of the Saudi business across the GCC and this is just the first step in that direction.”

Further evidence of growing interest in the Middle East for equipment comes with the news that the3721 International Powered Access Federation (IPAF) held its first Middle East Convention, in Dubai in January 2015.

“The UAE construction sector is growing at a fast pace, and so is the use of powered access equipment,” said Jason Woods, IPAF’s representative in the UAE.

“Along with that, there is increased interest in finding much safer and economical ways to work at height and this brings with it challenges for safe operation of equipment. IPAF’s first Middle East Convention aims to address the growing interest and needs of this region.”

Though certainly not growing at quite the pace that it was, China remains one of the strongest potential markets for any rental business. Hertz Equipment Rental’s global internal communications director Zoe White said that the firm opened a rental business in Shanghai in 2007. It has since expanded to cover 18 provinces throughout China, with five main business hubs and several smaller stores.

“After the earthquake in Chengdu, we realised a need to assist western China with a number of road projects,” said White.

“Western China is the first Hertz location in the world to operate a fleet of road pavers and rollers.

“This has been a great learning experience for Hertz in the possible expansion of road projects. Today the China market is expanding as safety regulations improve and labour costs rise. This has been most prominent in the aerial equipment space, where our machines are replacing bamboo and metal scaffolding.

“Municipal contractors painting many of China’s elevated road systems have been many of the earliest adopters of more efficient and less labour intensive aerial equipment. Every year, there are a number of painting projects to coat the bottom side of these highways across China. The contractors are looking for reliable, fast equipment to ensure they get the work done in their limited available time.”

Plant hire, equipment rental, leasing, call it what you will, being able to use a machine when and where you need it, with no further concerns relating to ownership costs, depreciation or sudden repair bills, remains a compelling argument for many contractors. Which is one of the main reasons for the continued growth in popularity of equipment rental across the world.

Rental has been big business in the UK, the US and some European countries for many years, indeed at least 80% of all machinery sold in the UK market goes to plant hire companies. However it remains a minor part of the construction equipment mix in other countries, as contractors prefer the security of asset ownership and machine availability, over the convenience and off-balance sheet attraction of rental.

Rental has also become an important outlet for many equipment manufacturers, not just as a possible customer, but as an operating division. The Cat Rental Store was among the first to become a regular feature of the market, in effect competing directly with some of its own customers.

“Cost of ownership, economic cycles, duration of jobs and contractors covering a wide range of geographic areas making transporting equipment less attractive, are all factors,” said a Caterpillar spokesperson.

“Cat dealers are making it easy for customers to do business by providing the latest technology in machines, with fleets of young equipment supported by expert advice to select the best solution for the job.

“As the economic situation across the globe is uncertain, rental will be more and more a solution that our customers will be looking for. We have markets that are already mature such as the UK or France, with high rental penetration, but rental penetration is growing in emerging countries too,” said Cat.

“Clearly specialisation is one of the trends that is being followed by many rental companies in Europe, while our network, with a large offer of Cat and complementary equipment, is able to provide machines to all the different sectors.”

THE FINANCIAL BENEFITS

So why rent? There are clear financial implications of rental versus ownership. Renting helps to reduce the burden of up-front investment, also cutting the cost of maintenance and eliminating the risk of expensive breakdown repairs. In effect you only pay for the time that you use the equipment.Hiring in machinery also keeps the cost of that plant off your balance sheet, with none of the usual concerns over depreciation or future residual value. Several European countries also offer fiscal incentives for rental, further boosting its appeal.

The flip side of that, is that a company might find it hard to raise finance when required, without solid assets on its books to offset and guarantee a loan. Having total control of fleet availability is also a strong concern for some.

While some companies have the luxury of maximum utilisation of their machinery, particularly in production-intensive areas such as quarrying and mining, general construction can be far more seasonal, with project duration much shorter and certainly well within the lifetime of the machinery. The rental industry can therefore supply a specific machine for a short duration task, with none of the investment concerns related to ownership.

Having the right machine for the job is an important consideration too. A company that has purchased a 40tonne excavator for instance will not want to put it to work on a site that really needs a 25tonne machine, as it will be inefficient and costly. Being able to specify the right equipment for the job, is often the most efficient method of working. In many cases rental also means that you will get the latest available plant, with the benefits of full legislative compliance, the highest levels of productivity and the lowest exhaust emissions, which might be an important consideration particularly for government-sponsored works.

When considering whether to opt for some sort of purchase agreement or a rental or leasing deal, companies have many things to consider. However both the rental machine and the purchased model can both be calculated as a total whole life cost.

For the rental machine you need to look at the daily or monthly rental rate. Then work out what your utilisation will be; do you need the machine all of the time or just for occasional work? Interest payments made on a monthly rental payment may not be the only interest that has to be paid either. If for example the company utilises an agreed overdraft, there will be additional interest owing, through making regular payments by using funds against that overdraft.

If you considering buying the machinery, the whole life calculation is more complex, with several variables that will only be realised over time. There is of course the purchase cost, plus any interest if the equipment is being purchased on a hire purchase agreement.

You will need to work out how many years the machine will be used by your company, and calculate a residual value to work out potential depreciation. Regular maintenance costs, including tyres or tracks will be another factor, even if the machine is supplied with a full repair and maintenance contract. Many companies work on maintenance costs being around 5-10% of the purchase cost of a machine, without incorporating wear parts such as bucket teeth or cutting edges. Plus you always have to factor in the unexpected breakdown, though to some extent that can be covered by an extended warranty, another expense to add to the list.

There is little doubt that, particularly as equipment becomes more complex and contractors move away from having their own service and maintenance departments, rental has become a more popular option. Passing the risk involved with machine ownership and operation to another company is for many, worth the additional expense of a rental contract.

Traditionally, the majority of rental in the construction sector has been related to smaller machinery, typically under 20tonnes operating weight. However, the European Rental Association (ERA) says that major construction contractors have started outsourcing their equipment needs further up the weight scale, to between 20-50tonnes. This includes wheeled loaders, excavators and compactors as well as the smaller mini excavators, backhoe loaders and compaction machinery. This may in part be due to shorter project durations, with contractors less inclined to invest in machinery for a limited return. No doubt there is also an element of management contracting at work too, as main contractors take over the project management but leave it to subcontractors to carry out earthworks and construction processes.

EUROPEAN RECOVERY SLOW

The European equipment rental sector is a mature market, yet it increased by 1% in 2013, to around €22.63 billion, according to the European Rental Association’s Industry 2014 Report. The ERA is predicting a more positive 2.8% growth in 2014 and a further 2.6% growth in 2015 despite the fact that recessionary cuts continue to bite among member states.As is so often the case, the figures vary wildly when you look at individual countries though. For example, while the UK remained the strongest rental market in Europe, with growth in 2013 of 10%, the Polish market in comparison saw a slowdown according to the ERA.

That said, Finnish rental company Ramirent says the Polish market and the Baltic States in general, look set to recover slightly over the coming year. “In the Baltics, our operations developed favourably, backed by stable market conditions,” said Ramirent ceo Magnus Rosen.

“In Europe Central, demand for equipment rental improved in Poland and the Czech Republic, while market activity is low in Slovakia.

“The construction market is estimated to increase in Lithuania by 3% and to decrease in Latvia by 2% and in Estonia by 7%. Residential construction in the Baltic States is estimated to grow supported by new building start-ups and improving consumer confidence.

“Non-residential construction is expected to recover in Latvia and Lithuania during 2014. The market in infrastructure construction is at a lower level due to a transition period in EU funding. High activity in the energy sector will support the Baltic equipment rental markets in 2014.” A report published by ERA in October 2014 puts Polish equipment rental market growth at 1.5% through 2014, while in the Czech Republic the construction market is expected to decrease by 3.8%.

Things are looking more positive in Ramirent’s domestic Scandinavian markets though. A forecast from the Swedish Construction Federation in October 2014 said that the Swedish construction market should increase by a healthy 11% in 2014, with residential construction in particular well up on the previous year.

Non-residential construction also looks healthy, with infrastructure projects in Stockholm and Gothenburg in particular boosting demand.

The Norwegian market is experiencing similar growth, though residential construction has dropped while infrastructure remains stable, thanks in part to government grants for railway and metro projects. That said, overcapacity in the Norwegian rental market was expected to have an impact on sales in the fourth quarter of 2014.

Denmark looks slightly healthier too, according to a report from the Danish Construction Industry, with growth in 2014 expected to hit around 2.5%. Health and education spending will push non-residential growth, while several new transport projects and energy investments will strengthen infrastructure.

One of the ways that Ramirent has continued to build its business is with longer-term rental contracts with major contractors, providing projects with equipment on a national and international scale.

“An important new agreement during the quarter was the signing of a three-year rental agreement with

“We continue to develop our organisation to efficiently cater for the specific needs of customers renting over-the-counter and for customers to whom we deliver integrated solutions.”

HIGHER ACTIVITY IN US RENTAL

The equally well established North American rental market, though still expanding, has had to revise its growth forecasts downwards slightly in the last year. That said, 7.3% growth in 2014 as opposed to 7.6% is hardly the end of the world and few companies will be playing down their investment in this market. The American Rental Association’s (ARA) latest forecasts put 2014 revenue at around $35.7 billion, substantially more than 2013. The slight drop in confidence relates to a small slowdown in construction output. However ARA forecasts see a further 9.2% of revenue growth in 2015, 7.7% growth in 2016 and 9.3% growth in 2017, to a total of around $49.8 billion.“This latest forecast continues to demonstrate a strong growth pattern for our industry,” says Christine Wehrman, executive vice president and CEO of the ARA. With such strong predictions, the ARA expects rental companies in the US to continue to invest more than 30% of their revenue in new equipment over the next five years.

In the next four years, the construction and industrial segment and the general tool segment are expected to experience near double-digit growth in US rental revenue. In 2015 construction and industrial rental revenue is projected to increase 9.8% and general tool 9.0%, followed by 7.9% and 8.1% in 2016, 8.6% and 9.8% in 2017 and 9.0% and 11.8% in 2018, respectively according to the ARA.

US-based United Rentals, perhaps the world’s largest equipment rental company with 882 locations in 49 US states and 10 Canadian provinces, reported North American rental revenues rising by 15.6% year on year in October.

“The third quarter provided further confirmation that our strategy and the North American construction recovery are both solidly on track,” said Michael Kneeland, United’s CEO.

“Our end markets are continuing to rally, creating numerous opportunities for well-managed, profitable growth. We reported a robust 16% increase in rental revenue for the quarter and more importantly, the discipline behind that growth is evident in our record earnings before interest, taxes, depreciation

and amortisation margin and gains in volume, utilisation and rates.”

Mr Kneeland continued: “While we reported very strong results, we believe they reflect just a fraction of what our company can achieve over multiple years in the forecasted upcycle. More immediately, we believe that the current uncertainty in the financial markets relates to global concerns, and not North America.

“We’ll continue to take the actions that drive returns over time, including rigorous fleet management, the expansion of our speciality rental lines, and transformational measures for greater productivity.”

UK-based Ashtead Group, which owns UK hire firm

“We are pleased to report another strong quarter as we continue to capitalise on recovering markets and take further market share in both Sunbelt and A-Plant,” said chief executive Geoff Drabble.

“Sunbelt delivered 22% rental revenue growth and A-Plant 19% which, together with a focus on operational efficiency, helped to deliver record underlying pre-tax profits of £120 million.

“We invested £284 million in capital expenditure and a further £32 million on bolt-on acquisitions in the quarter, as we continue our strategy focussed on organic growth supplemented by bolt-on acquisitions. Given the momentum evident in the business, we are increasing our full year guidance for capital expenditure to a range of £825 million to £875 million.

“As a result of this strong performance, and with a strong balance sheet to support future growth, we now anticipate a full year result ahead of our previous expectations.”

MIDDLE EASTERN PROMISE

The Middle East looks set to be a growth market for rental, with US firm“Regional expansion is a major strategic objective for Hertz Dayim Equipment Rental and I believe that Qatar is the right place to begin this expansion,” said chairman HRH Prince Khalid bin Bandar bin Sultan.

Hertz Dayim saw the opportunity in Qatar to provide a premium full line rental service as the majority of the competition in the market concentrate on one or two product lines. The company’s entry into the sector is based on a business model that provides a wide range of equipment to satisfy a greater number of customers involved in stadium construction, metro, ports, rail, drainage systems and highways, in addition to the traditional petro-chemical, oil and gas projects.

“Infrastructure and construction sectors in Qatar are expected to see massive growth because of the FIFA World Cup in 2022, leading to heavy demand for construction equipment and related rental services,” said the Prince.

“With Qatar’s planned infrastructure megaprojects over the next five years, Hertz Dayim is well positioned for expansion into the Gulf States. Regional presence will give scale to our business, as well as the flexibility to move fleet across different Gulf Corporation Council markets. We are confident that we will replicate the success of the Saudi business across the GCC and this is just the first step in that direction.”

Further evidence of growing interest in the Middle East for equipment comes with the news that the

“The UAE construction sector is growing at a fast pace, and so is the use of powered access equipment,” said Jason Woods, IPAF’s representative in the UAE.

“Along with that, there is increased interest in finding much safer and economical ways to work at height and this brings with it challenges for safe operation of equipment. IPAF’s first Middle East Convention aims to address the growing interest and needs of this region.”

EMERGING MARKET INTEREST

The Middle East is not the only growth area of interest to international rental companies. Though perhaps not performing as well as they were just a few years ago, all of the BRIC countries remain attractive to rental, as their construction and industrial growth continues apace. The strongest gains in equipment rental market penetration will almost certainly come in the emerging world, where hire will gradually climb towards the market penetration percentages currently seen in more mature markets. According to Caterpillar, rental is also growing strongly in China. The primary drivers are government requirements of state-owned enterprises to operate more efficiently from a financial perspective, continued privatisation of the construction industry, increased health and safety regulation and increasing labour costs.Though certainly not growing at quite the pace that it was, China remains one of the strongest potential markets for any rental business. Hertz Equipment Rental’s global internal communications director Zoe White said that the firm opened a rental business in Shanghai in 2007. It has since expanded to cover 18 provinces throughout China, with five main business hubs and several smaller stores.

“After the earthquake in Chengdu, we realised a need to assist western China with a number of road projects,” said White.

“Western China is the first Hertz location in the world to operate a fleet of road pavers and rollers.

“This has been a great learning experience for Hertz in the possible expansion of road projects. Today the China market is expanding as safety regulations improve and labour costs rise. This has been most prominent in the aerial equipment space, where our machines are replacing bamboo and metal scaffolding.

“Municipal contractors painting many of China’s elevated road systems have been many of the earliest adopters of more efficient and less labour intensive aerial equipment. Every year, there are a number of painting projects to coat the bottom side of these highways across China. The contractors are looking for reliable, fast equipment to ensure they get the work done in their limited available time.”