Construction machinery manufacturers are facing supply issues according to the VDMA

Construction equipment manufacturers are worried about the supply of components such as semiconductors. Image: ©Kornwa/Dreamstime

Construction industry order books are booming but delays in the supply chain as well as a lack of raw materials and rising material prices are leading to delivery problems and uncertainties in the sector.

The analysis comes from the VDMA, which says the construction machinery and building materials plant sectors are currently riding "a roller coaster". The association represents around 3,300 German and European companies in the mechanical and plant engineering industry.

The VDMA says the industry is not yet able to compensate for the losses from the effects of the COVID-19 pandemic in 2020, and that additional tasks related to the climate targets require political support.

From January to August of the current year, industry sales of German-manufactured construction machinery are 14% higher than in the same period of the previous year, adjusted for prices. If this trend continues until the end of the year, the VDMA says the industry will almost reach the level of 2019.

It adds that the industry has recovered from the shock of the pandemic year, but construction equipment manufacturers are worried about suppliers who cannot deliver certain components such as semiconductors.

Joachim Strobel, deputy board member at VDMA Construction says: "It's not up to us. We could deliver if the conditions allowed it. The demand for semiconductors is huge. Large companies in the electronics and automotive industries will be served first, if at all. Mechanical engineering, as an industry dominated by medium-sized companies, is lagging behind. The ongoing shortage of skilled workers exacerbates the situation."

It is not only economic issues that are driving manufacturers, according to the VDMA. Political and legal requirements due to climate targets present them with additional challenges. The industry is calling on politicians to differentiate and be ready for concepts that are open to technology.

"It cannot be that in the course of new exhaust gas directives we are accepted as collateral damage of a general ban on internal combustion engines," says Franz-Josef Paus, chairman of the VDMA. "The diesel engine for construction machinery, powered by e-fuels, which are synthetic fuels, is an environmentally friendly model that can prove its worth. Other alternative drive concepts require an infrastructure that is hardly feasible in most of our application areas."

Even though the building materials plant sector is more heterogeneously positioned and plans in longer cycles, the VDMA says it is struggling with similar supply chain difficulties in the current year. At the same time, the order books are also very well filled again. Cost pressure is particularly high in the plant engineering sector. Long project durations with uncontrollable raw material prices make stable costing difficult. The release of CO2 in the manufacturing process of building materials is another problem that needs to be eliminated. New processes already exist, but the VDMA says political framework conditions for them often do not.

It adds that the principle of technological openness must apply here just as it does in all areas, and that the key to innovation is open competition.

"We are always ready to exchange views with those with political responsibility on technical contexts and prerequisites. How can we best meet sustainability criteria? This question will accompany us in the future. In doing so, we should always keep the big picture in mind," explains Georg Baber, chairman of the VDMA cement, lime and gypsum plants division.

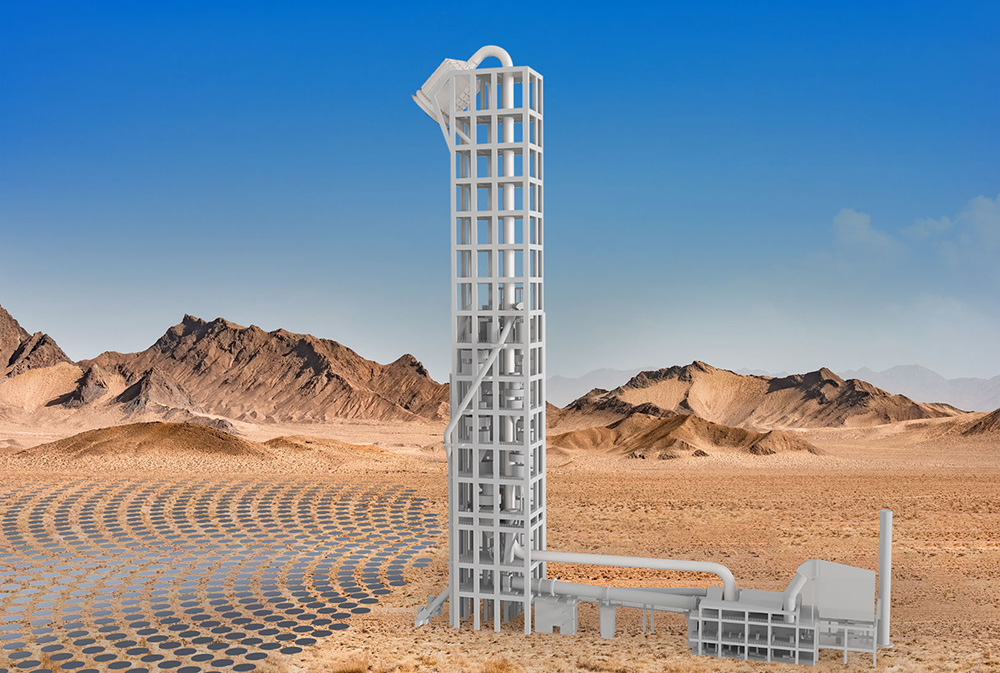

One example is carbon dioxide capture in the cement industry. "Climate neutrality requires the widespread use of new process technologies, such as carbon capture use or storage," says Christoph Reißfelder, group communication & investor relations at HeidelbergCement as a guest at the VDMA. "The new German government must quickly create the necessary infrastructures to help these future technologies achieve a breakthrough."