In March this year, bitumen supplier Nynas announced that it had stopped buying crude oil of Russian origin and would not be selling to customers in Russia or Belarus, due to the ongoing conflict in Ukraine.

Russia exported around 5 million tonnes of bitumen in 2021, according to Dubai-based bitumen supplier Infinity Galaxy, with around half of that going to countries that are opposed to Russia’s invasion of Ukraine. Russia’s lost customers are now looking to countries including the US, Canada, Iran, Greece and Italy for bitumen.

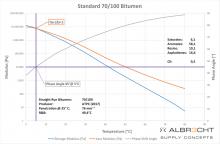

The two main grades of crude oil that Russia was exporting are Russian Export Blend and Urals, according to Frank Albrecht, managing director at ALBR3CHT Supply Concepts. Now bitumen suppliers will have to switch to different sources, which will impact on their products.

“The geographic origin of the crude determines the chemical composition of the crude and therefore the performance of the bitumen,” explained Albrecht. “The Urals, for example, contains a significant percentage of bitumen. Substitute products will probably yield less bitumen and the quality will fluctuate more.”

The main impact of quality fluctuations will be felt by producers of emulsions and PMBs, explained Albrecht. “It is unlikely to impact on performance because the suppliers making the emulsions and PMBs will be doing their homework. The main impacts will be on price and availability.”

With bitumen prices following crude prices – which have risen as a result of the Ukraine conflict – there are also likely to be additional costs for logistics, with the possibility that bitumen has to travel further.

According to Infinity Galaxy, bitumen prices started 2022 at US$385 to $395/tonne, reaching a high for the year of $495 to $505/tonne at the end of March and early April, and falling somewhat to $455 to $465/tonne by the end of May.

The rise in prices has caused many owners and contractors to pause the start of large construction projects, as they wait for prices to stabilise. Argus Media reported in April that the start of spring paving seasons in many countries in Western Europe had been pushed back, and that a sharp fall in demand for bitumen had been most apparent in North Africa and Central Europe.

New opportunity for Instant Bitumen

With risks to the disruption of bitumen supplies, Albrecht sees a new opportunity for his Instant Bitumen product. Instant Bitumen is created by combining a powder and a liquid – which can be transported, stored and then mixed together cold.

“For big road construction projects, it could be like the spare tyre on a car: ready to be used if there are problems with the usual bitumen supply,” said Albrecht.

Having spent some time developing Instant Bitumen, and with a patent pending, ALBR3CHT Supply Concepts and additive specialist Ventraco set up a 50:50 joint venture called B2Square to market Instant Bitumen in November 2021.

Designed to remove road construction’s dependence on mineral oil, Instant Bitumen reproduces the chemical components of bitumen from natural sources.

So, the maltene phase comes from polymerized cashew nut shell liquid (CNSL) and the asphaltene phase comes from naturally occurring hydrocarbon resins (NHCR) – or natural bitumen.

Ventraco produces bitumen rejuvenator RehoFalt from the cashew nut shells, with Instant Bitumen’s maltene ingredient based on that. Albrecht does not want to reveal where the natural bitumen comes from. “That’s a trade secret,” he said. “You need a very particular one.”

The first trial of Instant Bitumen took place at an asphalt production plant in Germany in July 2021. “We used the existing equipment with no modifications,” says Albrecht. “That was a high priority when we developed the product.” Now B2Sqaure is setting up pilot projects in Germany, South Africa, Japan and the UK said Albrecht.

Although Instant Bitumen was not developed with the decarbonsiation agenda in mind, it turns out that it has a significantly lower carbon footprint than the crude oil-derived version. The trial in Germany used 85% RAP with 3.7% aged binder and 1.5% Instant Bitumen binder which reduced carbon emissions from 51kg/tonne for conventional asphalt without RAP to 26kg, according to Albrecht.

Albrecht believes that Instant Bitumen could even be used to construct a carbon negative road, depending on factors such as the power used at the asphalt plant and the proportion of reclaimed asphalt used.

Associated Asphalt and Shell join forces on biogenic asphalt

Aggregate Industries has joined forces with Shell to create an asphalt mix which combines the carbon-saving benefits of warm-mix and biogenic bitumen, SuperLow-Carbon.

Biogenic bitumen is a general term for bitumen that contains some proportion of binder derived from plant-based materials. Tall oil pitch is one of the most common sources for plant-based binders. Lignin too, which can also be derived from soft wood, has also been trialled.

The combination of Aggregate Industries’ SuperLow warm mix asphalt range with Shell’s biogenic binder creates what a carefully worded press release calls “the UK’s first-ever commerically available biogenic asphalt”. So, perhaps not quite the UK’s first. Nynas confirmed that its biogenic binder product had been laid in the UK – although did not want to say where yet.

Shell will not say what plant-based material is in its biogenic bitumen, which it is calling Shell Bitumen CarbonSink. “The biogenic material differs from country to country,” said Raman Ojha, who leads Shell’s Construction and Roads division. “Companies are experimenting with quite a few components. The composition is proprietary. It needs to meet the specification, that's why we are working with partners like Aggregate Industries in their markets.”

China will be the next country after the UK where an announcement about a partnership involving Shell Bitumen CarbonSink is expected in June. Thailand, India, France and Germany will follow on, says Ojha.

According to Shell, while the manufacture of standard bitumen, which is derived from oil, emits 700kg of carbon/tonne of bitumen, Shell Bitumen CarbonSink emits 450kg. This translates to a saving of around 13kg of carbon per tonne of asphalt mix, working on a binder content of 5% or 6tonnes of carbon/km of road, assuming a width of 3.5m and a depth of 50mm.

Bio-based materials have long been used as rejuvenators for mixes containing higher proportions of RAP. And various bitumen and additive companies have been working on binders containing larger proportions of them.

Nynas reports conducting trials of roads containing binder derived from tall oil pitch laid in Sweden back in 2015 and 2016. It is launching its Nypol RE range of bitumen binders, which contain both polymer modified bitumen to prolong the life of a road and plant-based binder to lower the carbon footprint, into selected markets this year. Skanska used Nypol RE 73 on a section of road in Stockholmsvägen in Malmö, Sweden, last Autumn.

Kraton has also reported that Skanksa paved a section of road in Darlarna, Sweden, using asphalt that contained tall oil pitch. Chemical giant Kraton acquired Arizona Chemical, a company that specialises in tall oil-based materials for the highways and other sectors, back in 2015.

Peab Asfalt has also been experimenting with plant-based materials. It has laid several test stretches of road in Sweden in which some of the bitumen binder has been replaced with lignin, a plant-based polymer that is derived from softwood. Peab’s trials, the first of which was in 2020, have seen up to 25% of bitumen replaced with lignin.

One of the reasons why biogenic binder is such a good carbon story is that the road effectively acts as a carbon sink – hence Shell’s name. The carbon that has been sequestered by the growing of the plants is locked into the road and will not be re-released into the environment.

Nynas has reported on research it commissioned from Ancona University, which showed that RAP containing tall oil pitch could be successfully hot recycled.