Volvo CE is reporting a dip in net sales for Q2 this year—driven by the industry downturn—while still delivering on its transformation ambitions with its biggest product launches in years.

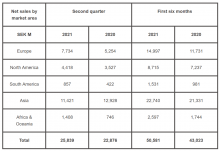

In Q2, 2024, net sales amounted to SEK 24,423 M (28,999). Adjusted for currency movements, this represents a decrease in net sales of 16%, of which net sales of machines dropped by 19% while service sales increased by 2% - once again demonstrating the increasing market value of service solutions to ensure customer productivity during tougher times. Both adjusted and reported operating income amounted to SEK 3,888 M (5,353), corresponding to an operating margin of 15.9% (18.5).

During the quarter, net order intake increased by 9%, mainly prompted by an increase in orders in China when compared to the slowdown in that region in 2023, but also by North America, as orders were restricted last year due to supply chain inefficiencies. Deliveries in Q2 this year were below 2023, caused by lower market demand in Europe and North America.

During its flagship Volvo Days event in June, Volvo CE unveiled its biggest product renewal in the company’s history. It involved both conventional machines, such as the launch of a new generation of state-of-the-art excavators and two new rigid haulers, the R60 and R70 stage V for regulated markets, as well as zero-exhaust emission solutions, most notably an expansion of the mid-size range with the L90 Electric and L120 Electric wheeled loaders, as well as the EWR150 Electric, Volvo’s first electric wheeled excavator. Scheduled for stepwise introductions over the next 12 months, they represent the next step on the company’s transformation journey.

In the second quarter, Volvo CE inaugurated its expanded facilities in Braås, Sweden, in its work to move towards more sustainable power sources for its articulated haulers.

Melker Jernberg, President of Volvo CE, says: “We continue to drive innovation and investments to remain at the forefront of the transformation to more sustainable solutions for the benefit of our customers, shareholders and society at large. It is a testament to our commitment to perform and transform that we are able to ensure profitability during challenging times while still setting the course for construction innovation.”

Compared to the historically high levels of 2023, there has been an overall market decline, particularly in Europe, where weakening business confidence has had an effect, and also in North America, largely due to normalisation in the replenishment of dealer fleets and lower-end-customer demand.