The growing worldwide consensus on the massive threat to humanity posed by climate change means that the need to reduce exhaust emissions from transport and construction is becoming ever more pressing. As a result, industry is changing and new solutions are being found for transport and construction that will help lower environmental impact. Although many solutions are being worked on, it seems that electric power looks set to be the key powertrain option for many transport and off-highway market requirements, and for good reason. Battery electric drive technology is well-proven and far more durable, as well as less complex, than fuel cell stacks for instance. Research into batteries is delivering successive gains in performance, with the latest systems delivering major increases in output.

Although the global construction machine market is a multibillion dollar sector, it is small in comparison to on-highway transport. And the take-up of electric drives in the off-highway segment will benefit from the economies of scale of developments for the mass market on-highway sector. In the on-highway segment, several countries have already set deadlines for the cessation of sales of new passenger cars featuring diesel engines. A number of European countries including France, the Netherlands, Norway and the UK have already said that they will follow this path in coming years. And sales of new petrol cars will likely be halted shortly after. But that China now looks set to announce its timeline for banning sales of new internal combustion-engined passenger cars is perhaps of even greater note.

For large on-highway vehicles such as trucks and buses, electric options are being developed. Buses and short haul delivery trucks for urban use with electric powertrains are already now being put into service. So far, 12 major cities globally: Auckland, Barcelona, Cape Town, Copenhagen, London, Los Angeles, Mexico City, Milan, Paris, Quito, Seattle and Vancouver, have agreed to purchase electric buses only from 2025. These will be introduced to help cut urban pollution (a particular problem in Mexico City as well as Los Angeles and Quito) as well as climate change gases. London already has over 2,500 electric hybrid buses in use, made either by UK firm Dennis or Chinese company

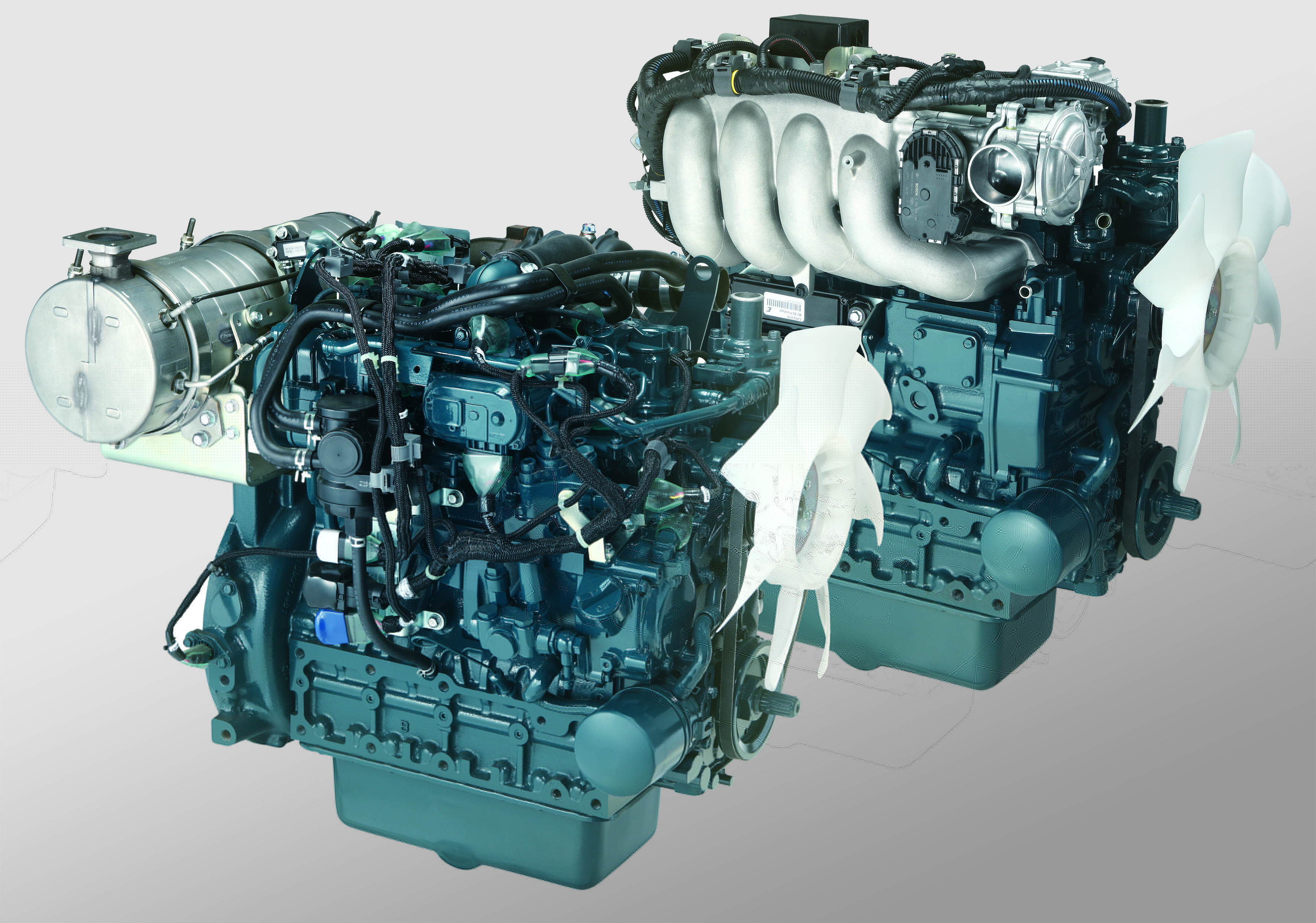

Two of the biggest players in the diesel engine market,

Both Cummins and Deutz are effectively hedging their bets. These companies are still continuing to develop and refine diesel engine technologies and deliver more powerful yet more fuel-efficient mobile power options that also have cleaner tailpipe emissions. These firms and others, such as FPT and

It is of note that both companies can be considered synonymous with the diesel engine, making their respective electric powertrain developments all the more significant. Deutz’s roots can be traced back to the very first internal combustion engine devised by Nikolaus Otto, as well as having been closely linked with some of the first practical developments of Rudolf Diesel’s compression ignition. Cummins became a leading producer of diesel engines first in the US during the interwar period and has long been amongst the global leaders in the sector.

Clearly, momentum is gathering for the widespread utilisation of electric drives in heavy-duty, on-highway and off-highway applications. But it is worth remembering too however that electric drive machines have been utilised for many years in the off-highway sector, particularly for special applications. Many large extraction operations have electric power infrastructure so that heavy face shovels can operate from a localised grid. And in tunnelling (and underground mining) applications, drilling, excavation loading and hauling equipment has long benefited from electric technology, helping to lower emissions and reduce ventilation needs. Drills and excavators have been available with dual diesel and electric power, able to use diesel drive on the surface and run from cables when operating underground at the face. More mobile machines such as loaders and haulers meanwhile have been available that are powered by batteries.

Electric construction machines will come in greater numbers and hybrid technologies will proliferate.

categories of construction machines featuring hybrid technologies will follow.

In the on-highway sector, heavy-duty electric powertrains are being developed. Cummins recently unveiled its AEOS concept truck, which offers a range of 160km on a single charge, extendable up to 480km. This features a 140kWh battery pack with two enclosures and a motor system offering an output of 350kW peak/225kW continuous and 3400Nm peak/1850 Nm continuous. It has direct drive/drive by wire with continuous acceleration and no shifting. Using a 140kWh charging station it can be charged in just one hour, and by 2020 charging should take just 20 minutes. Regenerative systems charge the battery pack with retardation while a solar array also helps with continuous topping up. Because the powertrain stops when the truck is at rest, it does not idle as such, further aiding range. Meanwhile a range-extender diesel can also be fitted if required. Other sophisticated technologies will include a platooning capability and a geofencing system for use in zero emission areas.

Cummins also recently announced its intention to expand its portfolio of electric drive technologies through the acquisition of the assets of

"To be a leading provider of electrified power systems just as we are with diesel and natural gas driven powertrains, we must own key elements and subsystems of the electrification network," said Tom Linebarger, chairman and CEO, Cummins. "By adding the expertise of Brammo and its employees to Cummins, we are taking a step forward in our electrification business and differentiating ourselves from our competition. As always, when markets are ready, Cummins will bring our customers the right power solution at the right time to power their success."

Operations from this acquisition will report under Cummins’ recently formed Electrification Business led by Julie Furber, executive director of Electrification at Cummins, and will continue to be based in Talent, Oregon. Founded in 2002, Brammo has been a pioneer in developing electric energy storage technology for mobile and stationary applications.

Linebarger recently explained the firm’s strategy in this respect and said, “Electrified powertrains are becoming affordable for certain types of commercial vehicles, particularly urban bus fleets and pickup and delivery trucks. By the time Cummins celebrates our 100th birthday in 2019, we will launch a fully electric powertrain, and a range-extended hybrid powertrain will follow in 2020. As more parts of the world generate cleaner electricity, we expect electrified powertrains to become an increasingly-viable option for other types of customers, too.”

Meanwhile Deutz is also gearing up in a similar fashion and recently signed a deal to acquire 100% of the shares in a fellow German company Torqeedo, based near Munich. This deal forms part of the firm’s E-DEUTZ strategy, which it says will extend its operations to include the development and manufacture of hybrid and all-electric system solutions for off-highway applications. The acquisition of Torqeedo will speed up the development of hybrid and electric drives and will allow the company to launch these into its current core markets sooner.

The company is initially investing around €100 million in this strategy, the majority of which will be spent on the acquisition of Torqeedo with its expertise in electric drives and system integration. Through this investment, the company will continue to operate its rapidly growing electric motors business under the established brand. Dr Frank Hiller, chairman of the board at Deutz explained that the purchase of Torqeedo is highly significant. He explained that this move will accelerate the development of electric power technologies within Deutz, allowing it to gain expertise quickly in a highly competitive market. Dr Hiller said that the company is using this acquisition as a key component for its low emissions drive strategy, which will incorporate both all-electric and hybrid systems, the latter featuring downscaled internal combustion engines. He explained that the acquisition allows Deutz to introduce highly sophisticated and advanced electrification solutions that are also economically viable for the c

ustomer. By making this step now, he believes Deutz is making a key strategic move that will cement its future. Torqeedo has considerable expertise in electric motors, power electronics, battery management and system integration, according to Dr Hiller.

However, the diesel engine still has plenty of turns of the wheel ahead and Linebarger commented, “Contrary to popular opinion, the internal combustion engine’s demise is not as imminent as some, who have a stake in electrification, may lead you to believe. Technology advances are having a positive impact on diesel engines and we will continue to innovate here, making our engines cleaner, more efficient and more reliable. We recently produced a demonstration truck and engine with Peterbilt Motors for the Department of Energy that achieved a 75% increase in fuel economy, a 43% reduction in greenhouse gas (GHG) emissions and an 86% gain in freight efficiency against a baseline truck. The power density of diesel is unmatched, and we believe it will take many years to replace diesel across the entire spectrum of products that we provide."

While electric drives may dominate in the future, diesel engines are not at the end of the road just yet.

All aboard the electric bus

The firm says that during peak hours the buses can operate continuously without stopping to recharge. Instead, the batteries can be charged once traffic is at off-peak levels, while on shorter routes they can even run throughout the day and be charged at night.

Volvo Buses has also expanded the range of battery charging options. As before, the new Volvo 7900 Electric can be fast-charged at the route’s end stops, via the open and competition-neutral OppCharge interface. However, they can now also be charged via cable, CCS, which is the European standard for charging of electric vehicles from the mains grid.

The first models of Volvo’s new generation of electric buses are expected to become operational at the end of 2018. The electric buses are sold in the form of a complete, turnkey solution, with Volvo taking care of maintenance of the vehicles and batteries at a fixed monthly cost.

These two-axle buses have all-electric propulsion and are 12m long, with a low floor and three doors. According to the firm they offer 80% lower energy consumption than corresponding diesel buses. And have an operating range of up to 200km depending on topography and driving conditions. In addition, Volvo’s advanced steering system, Volvo Dynamic Steering (VDS) and the Pedestrian and Cyclist Detection Warning safety systems are available as options.