User-pays is crystallising as the preferred option by governments and taxpayers around the world, said Jack Opiola, managing partner of international road usage charging consultancy, D’Artagnan Consulting.

Opiola, who chaired a session at the inaugural IRF - Roads Australia Regional Conference for Asia and Australasia in Sydney earlier this month, has been working with several US states which are wrestling with the ‘who pays’ issue.

“Some states are propping up their transportation funding with portio

User-pays is crystallising as the preferred option by governments and taxpayers around the world, said Jack Opiola, managing partner of international road usage charging consultancy, D’Artagnan Consulting.

Opiola, who chaired a session at the inaugural IRF - Roads Australia Regional Conference for Asia and Australasia in Sydney earlier this month, has been working with several US states which are wrestling with the ‘who pays’ issue.

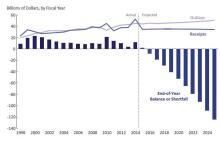

“Some states are propping up their transportation funding with portions of their general sales taxes, while others are addressing it with the addition of new sales tax on everything from restaurant bills to haircuts,” he said. “Still others have raised transportation taxes or proposed increases in public private partnerships and toll roads.”

But the solution is much simpler. “Put simply, the public believes it is more equitable for taxpayers to pay for infrastructure based on what they use, not on what they earn, or what they own or drive,” Opiola said.

“If there is one advantage the transportation sector holds over other government programs that depend on income, property or sales taxes to fund their services, it is the ability for roadways to be self-funding through direct user fees. It is a fairer, more equitable and sustainable system – the more you use, the more you pay.”

Opiola, who chaired a session at the inaugural IRF - Roads Australia Regional Conference for Asia and Australasia in Sydney earlier this month, has been working with several US states which are wrestling with the ‘who pays’ issue.

“Some states are propping up their transportation funding with portions of their general sales taxes, while others are addressing it with the addition of new sales tax on everything from restaurant bills to haircuts,” he said. “Still others have raised transportation taxes or proposed increases in public private partnerships and toll roads.”

But the solution is much simpler. “Put simply, the public believes it is more equitable for taxpayers to pay for infrastructure based on what they use, not on what they earn, or what they own or drive,” Opiola said.

“If there is one advantage the transportation sector holds over other government programs that depend on income, property or sales taxes to fund their services, it is the ability for roadways to be self-funding through direct user fees. It is a fairer, more equitable and sustainable system – the more you use, the more you pay.”