The proposed Fehmarn Belt Tunnel to link Denmark and northern Germany will never be economically viable, according a report commissioned by German ferry operator Scandilines. Revenue and traffic forecasts are unrealistically high, notes the report completed by German consultancy DIW Econ. It is unlikely that the latest cost to build the massive road tunnel, around €7.4 billion, would ever be recovered.

The Fehmarn Belt is a strait between the German island of Fehmarn and the Danish island of Lolland. Cur

RSSThe proposed Fehmarn Belt Tunnel to link Denmark and northern Germany will never be economically viable, according a report commissioned by German ferry operator Scandilines.

Revenue and traffic forecasts are unrealistically high, notes the report completed by German consultancy DIW Econ. It is unlikely that the latest cost to build the massive road tunnel, around €7.4 billion, would ever be recovered.

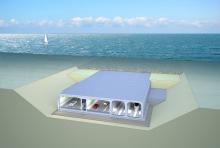

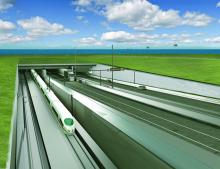

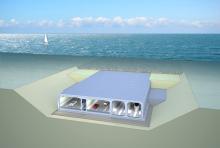

The Fehmarn Belt is a strait between the German island of Fehmarn and the Danish island of Lolland. Currently, a ferry connects the two islands. Final planning approval is expected in 2018 with project completion by 2028. But the approval process is currently bogged down over environmental issues being considered by the German state of Schleswig-Holstein in which the southern end of 17km immersed tunnel will surface.

DIW Econ’s 13-page report is based around mathematical calculations of a price war between the ferry and tunnel operators. Tunnel operator Fixed Link has said it will charge around €65 per car and €267 for a truck. The report suggests that the ferry operator will undercut the tunnel operator by half, and take 37% of the car market and retain at least 80% of the truck market.

“This will secure the ferry a decent profit, so that the ferry will stay in the market,” notes the authors. “The report finds that in the baseline scenario the tunnel incurs a loss of at least €3 billion over the 50 years [concession] due to the large market shares captured by the ferry.”

The report says that Fixed Link will make a profit only if the ferry services ceases operations. However, there are variables, acknowledge the authors, and the calculations and results could change with time.

The Danish state-owned company4782 Femern, which is responsible for designing and planning the project, has dismissed the claims. The project's financial situation is secure according to financial analysis of the project by international auditors on behalf of the Danish Ministry of Transport. Femern also said that the project will be paid off over 36 years as noted by the original plans.

Revenue and traffic forecasts are unrealistically high, notes the report completed by German consultancy DIW Econ. It is unlikely that the latest cost to build the massive road tunnel, around €7.4 billion, would ever be recovered.

The Fehmarn Belt is a strait between the German island of Fehmarn and the Danish island of Lolland. Currently, a ferry connects the two islands. Final planning approval is expected in 2018 with project completion by 2028. But the approval process is currently bogged down over environmental issues being considered by the German state of Schleswig-Holstein in which the southern end of 17km immersed tunnel will surface.

DIW Econ’s 13-page report is based around mathematical calculations of a price war between the ferry and tunnel operators. Tunnel operator Fixed Link has said it will charge around €65 per car and €267 for a truck. The report suggests that the ferry operator will undercut the tunnel operator by half, and take 37% of the car market and retain at least 80% of the truck market.

“This will secure the ferry a decent profit, so that the ferry will stay in the market,” notes the authors. “The report finds that in the baseline scenario the tunnel incurs a loss of at least €3 billion over the 50 years [concession] due to the large market shares captured by the ferry.”

The report says that Fixed Link will make a profit only if the ferry services ceases operations. However, there are variables, acknowledge the authors, and the calculations and results could change with time.

The Danish state-owned company