Altius Associates (Altius) has tipped institutional investor allocations to private infrastructure funds to grow dramatically over the next decade, either as a stand-alone asset class or as part of a broader real assets allocation. In a new report entitled ‘Infrastructure as part of a global investment portfolio’, Altius states that institutional investors currently have less than 1% allocated to infrastructure, including transport-related infrastructure projects, but it expects this figure to increase to

Altius Associates (Altius) has tipped institutional investor allocations to private infrastructure funds to grow dramatically over the next decade, either as a stand-alone asset class or as part of a broader real assets allocation.

In a new report entitled ‘Infrastructure as part of a global investment portfolio’, Altius states that institutional investors currently have less than 1% allocated to infrastructure, including transport-related infrastructure projects, but it expects this figure to increase to approximately 5% over the next decade.

The report describes how a long term demand/supply imbalance is creating strong fundamentals for infrastructure investments.

“Governments at all levels throughout the developed world are simply unable to supply the capital required for public infrastructure projects because of large deficits and severe budgetary pressures. Increasingly, they are seeking to access private capital to build new assets, expand or renovate existing assets, and supply the provision of essential services,” said Reyno Norval, infrastructure specialist at Altius Associates.

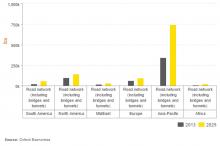

According to Altius, the need for massive infrastructure investment is not in dispute. In its recent global infrastructure report, the OECD estimates that Asia/Pacific region will need US$15.6 trillion in infrastructure spending, Europe US$9.1 trillion, Latin/South America US$7.4 trillion and North America US$6.5 trillion through to 2030.

Norval added: “Institutional private infrastructure is a relatively new investment area, although starting to mature. The momentum in the industry was temporarily slowed by the financial crisis, reaching a cyclical low point in 2009 - however infrastructure demand and investment has rebounded and the outlook is positive. This asset class shares characteristics with several other asset classes such as fixed-income, real estate, and private equity.”

In a new report entitled ‘Infrastructure as part of a global investment portfolio’, Altius states that institutional investors currently have less than 1% allocated to infrastructure, including transport-related infrastructure projects, but it expects this figure to increase to approximately 5% over the next decade.

The report describes how a long term demand/supply imbalance is creating strong fundamentals for infrastructure investments.

“Governments at all levels throughout the developed world are simply unable to supply the capital required for public infrastructure projects because of large deficits and severe budgetary pressures. Increasingly, they are seeking to access private capital to build new assets, expand or renovate existing assets, and supply the provision of essential services,” said Reyno Norval, infrastructure specialist at Altius Associates.

According to Altius, the need for massive infrastructure investment is not in dispute. In its recent global infrastructure report, the OECD estimates that Asia/Pacific region will need US$15.6 trillion in infrastructure spending, Europe US$9.1 trillion, Latin/South America US$7.4 trillion and North America US$6.5 trillion through to 2030.

Norval added: “Institutional private infrastructure is a relatively new investment area, although starting to mature. The momentum in the industry was temporarily slowed by the financial crisis, reaching a cyclical low point in 2009 - however infrastructure demand and investment has rebounded and the outlook is positive. This asset class shares characteristics with several other asset classes such as fixed-income, real estate, and private equity.”