Following strong sales at the end of last year, feedback from Construction Equipment Association (CEA) members suggests that sales in Q1 were still benefitting from orders placed last year on long lead times. Sales are expected to slow down during the year when the 'catch-up' is complete and the impact of more moderate construction activity is felt.

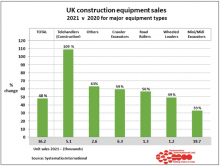

The sales pattern for the major equipment types is shown in the second chart below, comparing Q1 2023 levels with the first quarter of last year. This shows percentage changes in sales for the different machine types. Crawler excavators and wheeled loaders showed the strongest growth in Q1 at 15% up on last year. The most popular product, mini/midi excavators, has shown the weakest growth at 4.5% above the levels seen last year.

The pattern of sales on a regional basis in the UK and N Ireland is shown in the map below for Q1 2023 compared with the first quarter of 2022. This continues to show a mixed pattern across the regions. The strongest sales in Q1 were in Wales (+32%) and the South East (26%), while the weakest sales were in North Ireland (-14%) and the North West (-7.5%).

Equipment sales in the Republic of Ireland are also reported in the statistics exchange. Sales in March were also very strong at 20% above 2022 levels. This took sales in the first quarter to 11% above last year's levels and represents a strong recovery after sales last year ended up 8% below 2021 levels.

Systematics International Ltd runs the construction equipment statistics exchange in partnership with the Construction Equipment Association (CEA), the UK trade association.