Formed at the end of the Cold War, the European Bank for Reconstruction and Development has raised, and loaned, billions to revitalise infrastructure from central Europe to central Asia as Patrick Smith reports One of the highlights of the year for Thomas Maier has been the recent trip to Bratislava, the capital of Slovakia, where history was made. As the Business Group director in charge of the infrastructure sector at the European Bank for Reconstruction and Development (EBRD) he was present when contract

Formed at the end of the Cold War, the European Bank for Reconstruction and Development has raised, and loaned, billions to revitalise infrastructure from central Europe to central Asia as Patrick Smith reports

One of the highlights of the year for Thomas Maier has been the recent trip to Bratislava, the capital of Slovakia, where history was made.As the Business Group director in charge of the infrastructure sector at the

"This is one of the landmark deals of 2009 for us. It is the first big infrastructure transaction that has been closed without state guarantees since the advent of the financial crisis. I hope it signals the return to normality for big infrastructure projects in our sphere," said Maier who joined the EBRD as senior project manager in 1993 from NatWest Markets where he worked on acquisitions, management buy-outs and highly leveraged transactions in the UK and Western Europe. He became director in 2001.

The bank was quick to respond last year following the start of the economic downturn, which had a major impact in central and eastern Europe (and parts of Asia) where its countries of operations are located.

This threatened the significant progress made since the EBRD started operations in April, 1991, with headquarters in London, England. These countries face limited availability of commercial lending, private equity, public and state funding, so the EBRD has sharply increased its investments in 2009 while working closely with independent financial institutions and partners to find practical, efficient and timely solutions.

In an interview with

"What we have seen is that our activities in places such as Poland, Slovakia, Russia and central Asia have increased significantly. Today the EBRD is needed more than ever, and this year we have increased our activities by about 40%.

"What the crisis has shown is that in difficult times countries such as those mentioned require our assistance. We will carry on with this as long as the crisis continues."

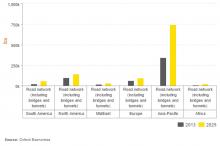

Indeed, as a key investor in infrastructure projects generally, to date the bank has invested over E6.5 billion in around 170 transport infrastructure projects.

Total project value on the 170 transport projects is €57.5 billion, nine times more than the EBRD has invested. Total project value on all EBRD activity is €142 billion, three times more than the EBRD has invested.

With about half of the transportation team's activities covering various financial packages for roads, the EBRD is bringing private finance to the modernisation of a transport system (that of the Slovak Republic) with a loan for the construction of the R1 motorway, part of the east-west national corridor.

R1 is an important transport link in the south-west of the Slovak Republic and the project launches the government's PPP programme to upgrade the road network in order to stimulate the economy and improve regional links.

The EBRD is providing a €200 million loan to

The project includes construction of a total of 52km of highway, including the sections between Nitra and Selenec; Selenec-

Beladice; Beladice-Tekovske Nemce, as well as the Banska Bystrica northern bypass.

Total cost of the project is approximately €1.3 billion, and the EBRD's loan will cover 20% of the total debt required with the rest of the debt funding being co-financed by a group of commercial banks (€780 million).

Slovak Transport Minister Lubomir Vázny, said: "We consider the financial closing of the R1 to be a success for the Slovak Republic, as well as for all partners who took part in this transaction. Despite the current adverse conditions on the international financial markets, we have achieved a common objective that will set an example for other PPP projects in Slovakia."

EBRD first-vice president Varel Freeman, said: "This project is an important step for modernisation of the Slovak transport infrastructure with the participation of the private sector. The successful closing of the transaction in the current economic downturn and liquidity crisis provides a strong market signal that well structured PPP projects remain a viable alternative for developing public infrastructure even under adverse market conditions."

However, while this is another success story for the EBRD, more challenges are yet to come.

"The really big test will come when even bigger PPPs in Slovakia and elsewhere come up for closure this year and next year. At

€1.3 billion, R1 is one of the smaller motorway projects," said Maier.

He picks out a further two motorway PPPs in development in Slovakia; the A3 project running through the Transylvanian Alps in Romania and the Moscow-St Petersburg motorway in Russia, a "very big and ambitious" project, where the EBRD is supporting the project and hopefully the closing of the transaction.

"We have quite a number of PPPs in development, which we hope will see closure. I have found that closing a PPP in Slovakia is less challenging than closing one in Russia."

However, the EBRD, the first international financial institution of the post-Cold War period, is involved with other major infrastructure projects.

"With our product palette we are not only doing lending, but we do also do equity investment. We are one of the main equity partners across industry. For example, we are shareholders with

said Maier.

"There is a lot that we do, and in the railway and highway sector we sponsor not only as a provider of capital but as equity partners. In the railway sector we have been supporting Ukraine and Russia on a sovereign basis, taking full corporate responsibility."

The EBRD was the collective response of Europe and many other countries to unprecedented changes and challenges in central and eastern Europe in 1989 as the Berlin Wall fell and the region moved from systems based on centrally planned command economies to free democratic institutions and market economies.

From the outset, it differed among multilateral financial institutions in that it has had an environmental mandate committing it to finance projects that are environmentally sound and sustainable.

Working in 30 countries from central Europe to central Asia (including Mongolia), the bank's aim is to support the financing of projects that serve the transition to market economies and pluralistic democratic societies.

The bank is owned by 61 countries and two intergovernmental institutions, and is the largest single investor in the region, mobilising significant foreign direct investment into its countries of operations. The bank invests mainly in private enterprises, usually together with commercial partners, and it has a subscribed capital totalling €20 billion (€5 billion paid-in and €15 billion callable).

"Basically we are a commercial bank and we finance project lending and operational needs by borrowing funds on the international capital markets," said Maier.

The bank does not directly utilise shareholders' capital to finance its loans, but its AAA/Aaa/AAA ratings enable it to borrow funds in the international markets by issuing bonds and other debt instruments at highly cost-effective market rates. By raising funds on competitive terms, EBRD can structure loans which best match the requirements of its clients in its countries of operations.

Maier added: "I think on the whole motorway and other infrastructure projects require more long lead times including the environmental and public consultation procedures.

"What we are seeing is well prepared projects such as the R1 construction, where work can start almost immediately: a lot of work has gone in to make sure everything can go as fast as possible.

"People always say Albania is difficult, and it can be true, but in the airport sector we have supported a successful PPP: so successful that the Tirana Airport innovative structure makes it a showcase for private-sector investment in medium-sized airport operations in the region.

"It is for countries such as Albania that the EBRD was set up. We don't shy away from difficult countries. We have learned from the good projects in difficult countries and the bad projects in good countries."